IESE Insight

Searching highs and lows: Understanding international search funds

Search funds are gaining traction overseas, with a new peak of international activity spanning four continents (outside North America).

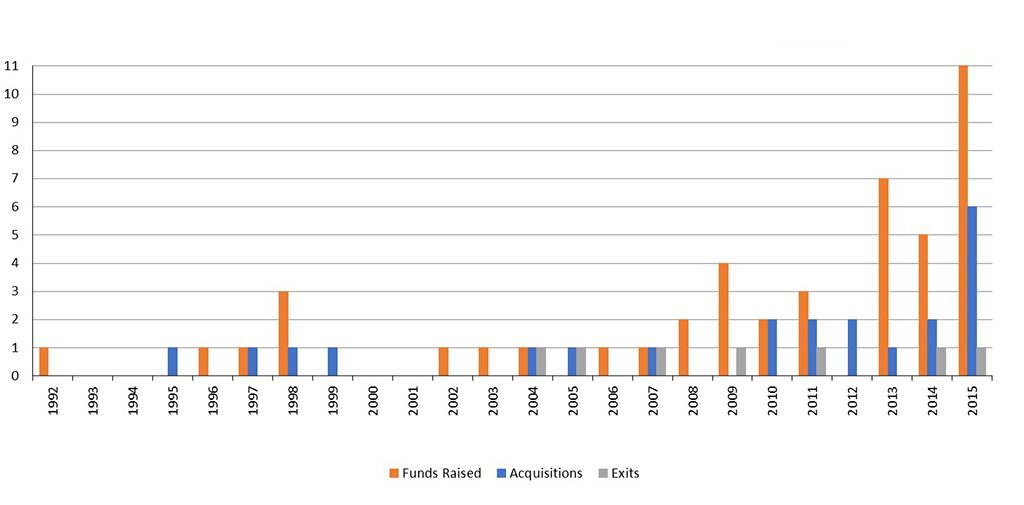

The search is on. In 2015, international search funds reached a new peak of activity — with 11 new funds raised and six acquisitions completed within the calendar year.

The third biennial study of international search funds — published in 2016 by IESE in partnership with Stanford Graduate School of Business (GSB) — surveys 45 first-time funds outside the United States and Canada, tracking their development in 14 countries spanning four continents.

And on October 27-28, 2016, the 2nd International Search Fund Conference at IESE brought together search fund entrepreneurs and investors. The conference is also designed to introduce the funded search model to aspiring entrepreneurs and investors interested in a new entrepreneurial investment model.

Together, the conference and the published report help deepen understanding of a new asset class, one that is still relatively unknown outside the United States, where it was first developed more than 30 years ago. Search funds are investment vehicles to finance entrepreneurs (often fresh from business school) as they hunt for opportunities to acquire and grow existing companies. Typically, about 10 to 15 investors put money up to pay a modest salary to a recent MBA or two as they search for a promising company to buy, operate, and, ultimately, offer an exit opportunity for the fund investors.

When it works out well, young entrepreneurs get the opportunity to put their studies into practice at the helm of a company and investors are rewarded with a healthy yield.

Actividad de los fondos de búsqueda por año

A winning history, with results

Stanford GSB has been analyzing search funds since 1996, publishing a biennial report since 2001. In 2011, IESE set up the International Search Fund Center to work with international searchers and conduct a separate analysis of the growing cohort of funds located in Latin America, Europe, Asia and Africa.

From 2010 on, Stanford GSB tracked only those funds in the United States and Canada. Its 2016 analysis of 258 qualifying funds through December 2015 found that the aggregate pre-tax internal rate of return (IRR) was 36.7 percent. At the same time, the aggregate pre-tax return on invested capital (ROI) was 8.4x for this asset class.

IESE's 2016 analysis, following the same metrics, found that international funds' IRR was very similar at 33.4 percent. However, the international ROI was lower at 2.8x, probably due to shorter holding periods. Indeed, more than three-quarters of the 45 funds analyzed by IESE were formed after 2007, and only about half of those funds acquired a company. IESE's authors warn that it is still "too early to draw firm conclusions" about the asset class.

Instead of studying results at this early stage, the IESE report emphasizes the characteristics of international search funds: Who, what, where, when, why and how are all explored in surveys.

Characteristics of the search

The report, co-authored by Lenka Kolarova, Peter Kelly, Antonio Dávila and Rob Johnson, is based on surveys completed every two years by the searchers. Who are the searchers? Eighty-nine percent graduated from an MBA program and 75 percent started raising their search fund within two years of graduation. In other words, they are relatively young and well-trained, consistent with the search fund model. Search-fund pioneer and professor H. Irving Grousbeck described it to MBAs as "the most direct route to owning a company that you yourself manage."

Survey questions cover the four main stages of the search-fund life cycle:

- Raising a search fund

- Search and acquisition

- Operation

- Exit

Raising the funds

The study suggests that international searchers are starting to raise money faster and raise more of it. The median amount raised has risen from $282,500 to $383,395 per searcher — and note that 40 percent of funds are run by pairs of searchers, working in partnership.

Furthermore, the time required to raise funds decreased from six months to between four and five months (median time). This is still longer than the three months reported by Stanford GSB for U.S. and Canadian funds, as international searchers tend to lack access to serial search-fund investors and must spend more time seeking new sources of support and explaining the model.

Searching and acquiring

Mapping the 45 international search funds as of December 2015, 12 were located in the United Kingdom (where the oldest fund was founded in 1992), nine in continental Europe, 11 in Mexico, seven in the rest of Latin America, three in Asia, two in the Middle East and one in Africa.

International searchers had a diverse range of professional experiences and generally took "opportunistic" approaches to evaluating target acquisition companies. That said, the survey found a preference for acquisitions in business services, IT, health care and education — in descending order of popularity.

Running the company

The searcher (or pair of searchers) ends up being the owner-operator of the company acquired. According to the search model, this role helps ensure that searchers are "more highly motivated to make the business succeed" than salaried executives.

The operational role of the searcher is similar across North American and international funds. However, unlike their U.S. counterparts, European companies acquired generally have a board of directors. This 2016 report was the first to include questions about the quality of the board. Initial results were positive: searchers rated their boards 8/10 (median score) for effectiveness (10 being best).

Performing financially and exiting

As mentioned above, international search funds have achieved an aggregate return on investment (ROI) of 2.8x, and internal rate of return (IRR) of 33.4 percent. But the co-authors repeatedly warn that it is still too early to draw conclusions, with many acquired companies operating for less than a year and only seven exit events studied.

To know what happens next, 2016 data collection is well underway. The 2018 edition of this study should help the international business community to better understand how search-fund trends could impact the next business generation.

In the meantime, the search continues: despite the obstacles they face, more international investors and entrepreneurs than ever hope to maximize profits, growth and professional development using this innovative model.

Methodology, very briefly

This study is drawn from a pool of 45 first-time search funds, the earliest of which was formed in 1992. It only considers first-time search funds, excluding self-funded searches and second-time search funds.

Each searcher, or pair of searchers, was asked to complete a survey that included questions about their personal background and professional profile. They were also asked about the fundraising process and the geographic focus, target industries and company characteristics of their search fund. When possible, searchers were also asked about acquisitions, operations, liquidity events, and returns or valuation (and implied return).