IESE Insight

Aftermath: Where do Spanish companies stand after the economic crisis?

The Spanish business landscape changed between 2006 and 2014? Here is a breakdown of the repercussions on the number and size of companies, sales volume and productivity.

Employment was the main casualty of the economic recession in Spain: 21 percent of jobs were destroyed between 2006 and 2014, nearly 2 million in all.

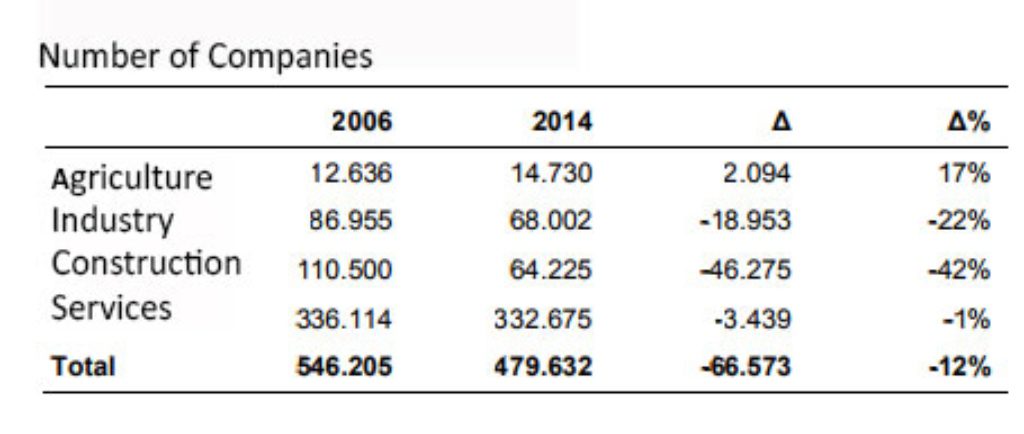

In those eight years, the number of companies also fell by 12 percent, while total revenues shrank 10 percent.

Consequently, "productivity per employee increased by 14 percent, as job destruction far outpaced the decline in business revenue."

Still, productivity growth was not homogeneous, rising 35 percent in the industrial sector, 30 percent in agriculture and 7 percent in services, while dipping 5 percent in construction.

In 2006 the average Spanish company had 16.2 employees, a number which had slipped to 14.5 in 2014.

These data are from research by IESE's Miguel Ángel Ariño which examines the fallout of the crisis on Spanish businesses by sector and region.

The industries most and least affected

In the construction sector, the recession decimated 65 percent of revenues, 64 percent of jobs and 42 percent of companies. As a result, its relative weight in the Spanish economy went from almost 14 percent in 2006 to just over 5 percent in 2014.

The industrial sector saw a 28 percent drop in employment and a 22 percent decline in the number of companies, although total revenues remained nearly even, slipping just 2 percent.

In the service sector, 8 percent of jobs were destroyed, a percentage well below the national average, with virtually no change in the number of companies or revenues, which dipped a scant 1 percent.

The report notes that the agricultural sector did well during the crisis, with revenues climbing 29 percent, the number of companies up 17 percent and just 1 percent of jobs lost. Despite this bright spot, the report acknowledges that the agricultural sector accounts for a mere 1.4 percent of the Spanish economy.

Geographical Analysis

The regions least affected by the recession were Madrid and the autonomous communities in the north of the country: the Basque Country, Cantabria, Galicia and Navarra. At the other end of the spectrum, the biggest losers were Castilla La Mancha, Valencia, Canary Islands, Andalusia and Aragon.

Ariño analyzes the different sectors in each of Spain's autonomous communities and recommends that each invest in certain sectors, based on the growth experienced between 2006 and 2014 and that sector's relative size in the region.

The report also underlines that "the autonomous communities that saw a large number of companies close down did not suffer as much in terms of revenue, whereas those that were able to sustain their companies took a big hit in revenues."

This seems to indicate that inefficient firms disappeared "in places where more companies were lost" and survived in places that saw a lesser degree of decline.

Methodology, very briefly

The study examined the companies in the SABI (Sistema de Análisis de Balances Ibéricos) database, which does not include the financial or insurance industries. It likewise excludes analysis of the public sector, the self-employed and small businesses, which in Spain total approximately half a million companies.