IESE Insight

Spanish business angels: still young, still male, still digital

The profile of a typical Spanish business angel has remained fairly static over the last year: a young man who co-invests primarily in digital projects.

The typical business angel from Spain has essentially the same profile that he (almost invariably he) had last year, albeit he is now slightly younger and has a broader investment capacity and scope.

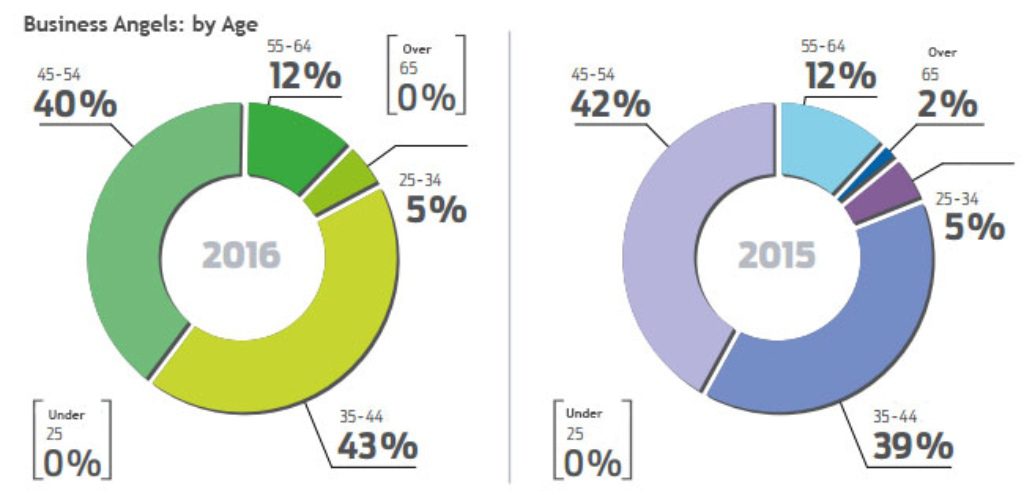

Nearly half (48 percent) of business angels are under 45 years old — compared to 44 percent in 2015 in those age groups. There was also an increase in the proportion of investors investing abroad and those with expanded investment capacity. Meanwhile, men still account for 90 percent of investors.

These are among the findings presented in the second annual edition of a study by IESE's Juan Roure and Amparo San José in collaboration with the Spanish Association of Business Angels Networks (AEBAN).

New in year two

This year, the study looks at project valuations — which averaged 800,000 euros in the seed phase and double that for startups that had entered the market.

Investment incentives and red flags are also considered. Business angels cite "an extraordinary opportunity" (55 percent) as the main reason to invest more than expected, followed by "a divestment option that brings liquidity" (42 percent). Meanwhile, reasons to dismiss potential investments were based on doubts about entrepreneurs' ability to manage the company (45 percent) and a lack of confidence in the project team (25 percent).

A well-defined profile

So, who are Spain's "angel investors?" How did they get started in this kind of investing? What projects do they target, and how to they evaluate them? The new report adds depth to the portrait:

- Friends and business partners are the main initiators: Most investors start out by investing in a friend or associate's project, or through a network of business angels.

- Newbies: There is a high proportion of new investors: 64 percent just started investing in the last five years. Only 19 percent have more than 10 years' experience.

- Suboptimal portfolio: The limited track record of most business angels is probably why they are not very diversified. Forty-five percent are involved with just one to five projects, and only 30 percent invest in over ten.

- Solid investment capacity: Thirty-six percent say they have more than 100,000 euros a year to invest — enough to build a solid investment portfolio.

- Digital enthusiasts: More than half of respondents invest in ICT and software. Other highly popular investment areas include commerce and distribution (including e-commerce), healthcare, media and digital content.

- Pro-partner: Only 6 percent invest alone. The most common practice is to team up with other business angels (86 percent). Meanwhile, 62 percent have benefited from public co-investment programs, 44 percent have participated in some type of investment with venture capital funds and 21 percent have chosen to invest through crowdfunding platforms.

- Lofty expectations: Most business angels (86 percent) expect at least a threefold return on their investment. In the past year, only 41 percent of divestments achieved that kind of profitability.

- Without tax deductions: Although various financing instruments for entrepreneurs are widespread, the use of tax deductions for investments is very limited (27 percent).

Challenges ahead

To improve angel investing in Spain, the report identifies a number of measures that could be taken:

1. Stress the importance of building a diversified investment portfolio — which remains a challenge as newbies continually enter the market.

2. Bring in large companies, either as possible divestment options for startups or as mentors or drivers of innovation in their industries.

3. Promote greater transparency and learning by sharing information on company valuations, the roles of various market players, as well as the scope and dimension of angel activities.

4. Provide incentives for women to be more present and active as investors.

Clearly, diversification is key — not only in portfolios but also in the profiles of investors.

About the research

The study is based on responses to a survey sent to all of AEBAN's networks and partners and more than 400 active investors. A total of 172 valid surveys were collected — 14 percent of which came from AEBAN networks, 16 percent from other agents in the ecosystem and the remaining 70 percent from the direct-mailing campaign to individuals identified as active investors.