IESE Insight

Understanding the paradox of socially responsible investing

If social responsibility is about putting the common good first and successful investing is about maximizing profits, where does that leave the growing realm of socially responsible investing? Under what conditions does it thrive? A study of 19 countries shines a light on the paradoxical logics at play.

Worldwide, the financial sector is growing. That means there are more investment bankers, commercial bankers, asset managers, etc., at the same time there are so many serious social problems to fix.

One parallel trend is the rise of socially responsible investing (SRI) funds, where financiers apply their skills to help promote social good. But how does this work in practice? Is there a point at which financial thinking could undermine the social goals of SRI funds?

Yes, is the short answer provided by the research of Shipeng Yan, Fabrizio Ferraro and John Almandoz. They find that financial thinking (as a means) can coexist in harmony with social aims (as an end) in certain environments, but only up to a point before the two logics become adversarial to the detriment of new SRI foundings. When individualism and the pursuit of profit maximization are the prevailing norms in particular environments, funds committed to social good may be found illegitimate and are thus constrained. On the other extreme, in environments where there's little financial know-how, SRI funds are unlikely to get up and running. Somewhere between these two extremes there's a sweet spot, where financial and social goals mix and may bring about new SRI foundings that can lead to institutional change in the financial sector.

Looking at Logics

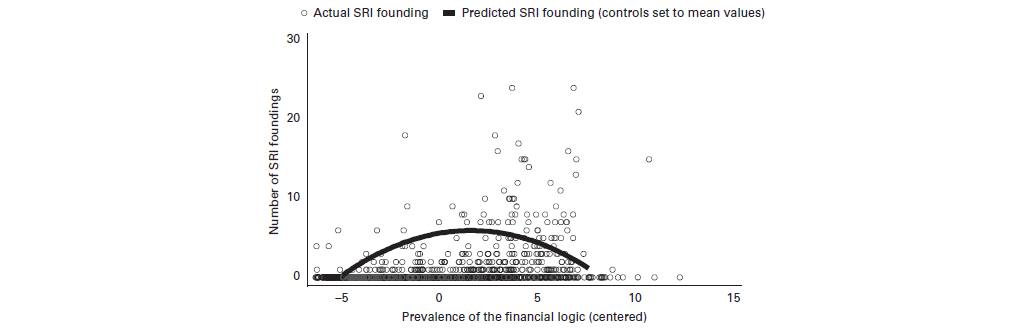

The authors draw on interviews with SRI professionals in Asia, the United States, and Europe, as well as data analysis. In the data analysis, the authors track 19 countries' "financial logics" by looking at the percentage of people employed in the financial sector. These people tend to be educated in economics and finance — fields promoting self-interested and profit-maximizing behavior that also provide the type of skills necessary for new SRI entrepreneurship. Based on their research, the authors predicted that there would be a relationship between the prevalence of financial logic and the founding of SRI funds that looks something like an upside down "U" curve (the solid line below):

.png)

Source: Administrative Science Quarterly © the Authors 2018

Analyzing the data, the researchers found support for their theory. The tipping point appears to be when the financial logic's constraining force — because of its profit-maximizing end — offsets its enabling power for this form of social innovation.

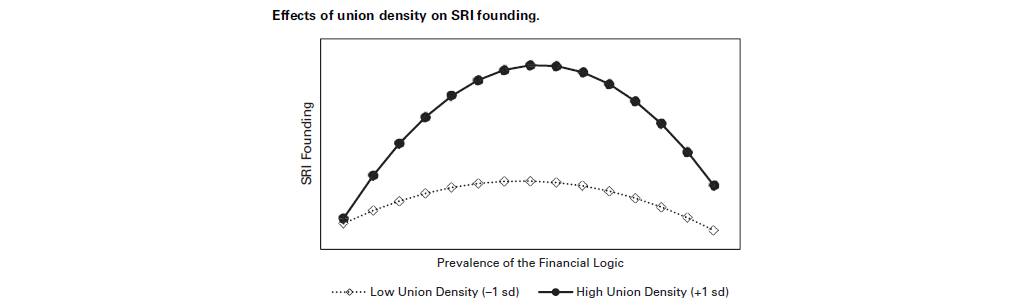

In addition, the authors propose and find evidence for the moderating effect of certain other forces in society known for advocating socially responsible practices -- namely, religion, workers' unions and pro-environment, green political parties. In the case of union participation, the data bore this out, exaggerating the upside-down U-shape:

.png)

Source: Ibid

Methodology, Very Briefly

The authors gain their insights from observing an Asian SRI industry association, interviewing SRI professionals in the U.S. and Europe, and other field work. They build a panel database of SRI fund foundings from 1970 to 2014 in 19 countries to examine how the financial logic in those countries interacts with alternative logics to promote or stifle institutional change.

This research was supported by the European Research Council under the European Union's Seventh Framework Programme (ERC-2010-StG 263604-SRITECH).