IESE Insight

Striking oil with more precision in financial regulation

Do tougher reporting regulations make an impact? Yes, when it comes to companies' oil reserves estimates, a pioneering study finds. Requiring greater precision has increased disclosures' informational value and reduced information asymmetry among investors.

In terms of informational efficiency for the stock market, is it more effective to have strict regulation or give companies more leeway? If the rules on financial reporting get tougher, does that reduce information asymmetry, i.e., does it improve the quality of the information available to all investors? Meanwhile, how does it affect companies' stock prices?

These are fundamental questions for all stakeholders, and very apropos, given the current emphasis on tightening regulations even further. These questions are addressed in a pioneering study by IESE professors Marc Badia, Miguel Duro and Gaizka Ormazábal, in collaboration with Bjorn N. Jorgensen.

The authors focused on the oil and gas industry in the United States and Canada. Specifically, they analyzed the consequences of two nearly identical standards: Canada's Standards of Disclosure for Oil and Gas Activities (NI 51-101) and the United States' rules on Modernization of Oil and Gas Reporting (MOGR). Both tightened up the regulation that requires companies in the industry to disclose concrete information about their main assets for future exploitation, oil and gas reserves.

This is the first time that the effects of introducing a stricter and quantifiable definition of "proved reserves"-- with at least a 90% probability of being produced -- have been documented. Hence the relevance of the study, which covers a large sample of oil and gas companies between 2002 and 2011.

Equally significant are its findings. The introduction of both regulations resulted in greater precision and, therefore, greater informative value of companies' reported reserves. In other words, they better reflected reality. So companies tempered their "over-optimistic" estimates when the new rules were issued.

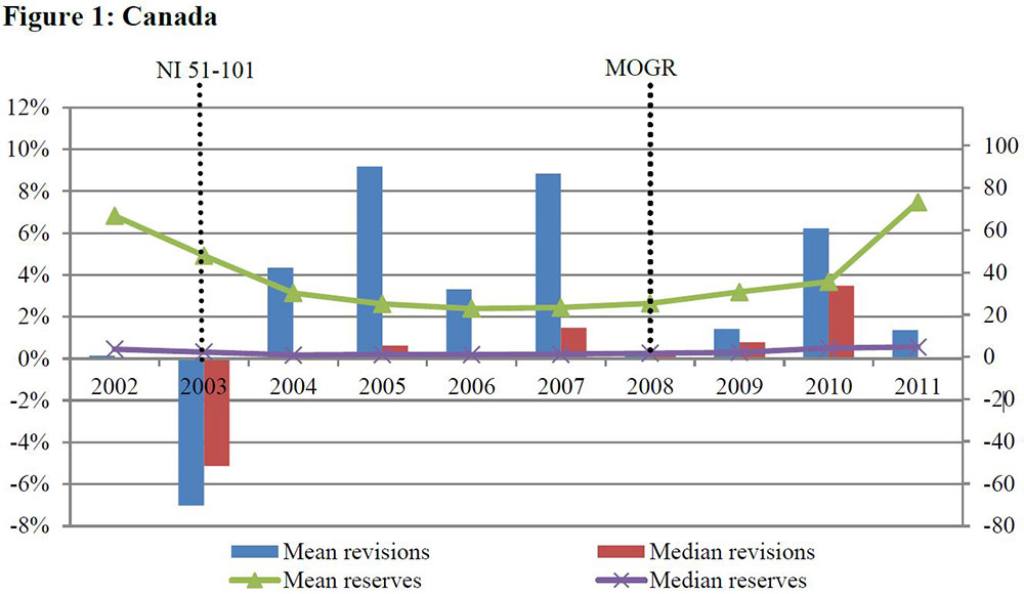

As the following chart shows, the new, stricter Canadian regulation in 2003 led to a significant downward revision of the proved reserves in Canada that same year.

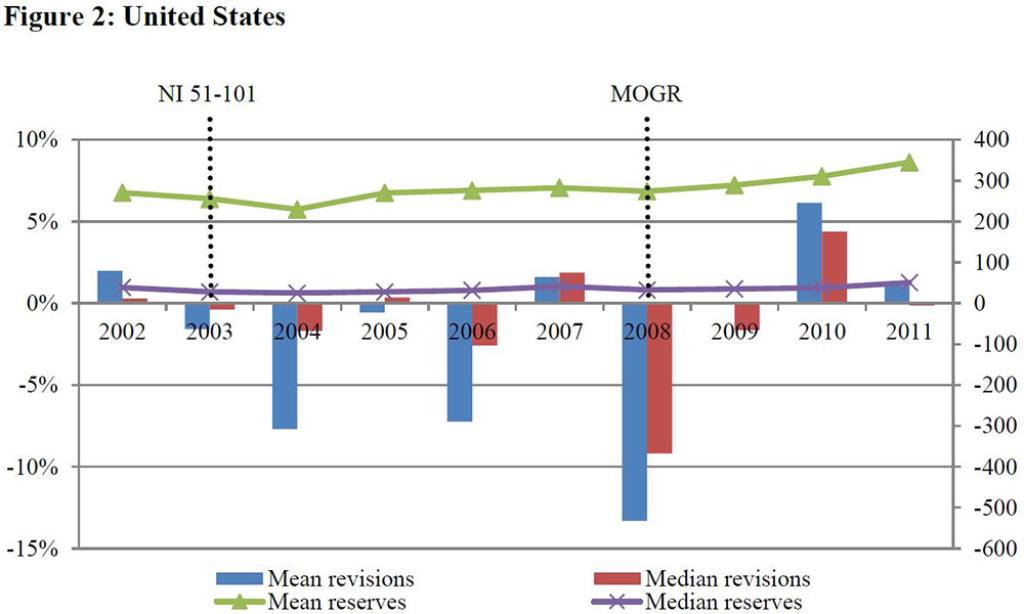

The same happened in the United States in 2008, when its regulations were similarly modernized. Although note that the negative revisions were even more abrupt in the U.S., as the following graph shows.

In both countries, companies in the industry tended to explain to shareholders that strong downward revisions occurring around the change in regulations were due to issues related to oil and gas prices. However, the above graphs show that the significant decline in the Canadian revisions of 2003, the year of the regulatory change in that country, did not have its equivalent in the United States. And neither was the sharp decline in the 2008 U.S. revisions mirrored by a similar phenomenon in Canada the same year.

The research also shows that the greater precision of the new regulations resulted in an increase in the information capacity for the stock market on the variations in proved reserves and a reduction of the price spread.

The scandal that changed everything

While Canada outlined the path forward in 2003, it was a scandal that would bring about the regulatory change for its neighbor. On January 9, 2004, Royal Dutch Shell lost 8 billion pounds sterling in market value in a single day after announcing a 20% negative restatement of its reserves.

The scandal led to the ouster of the CEO and a $450 million class-action lawsuit against the British-Dutch company, as well as an uproar in the media. The press accused Shell of inflating its reserves and began to question the rules regulating estimates, echoing concerns that had swirling around the market for several years.

The Shell case and other complaints prompted the U.S. Securities and Exchange Commission (SEC) to introduce tougher regulation in 2008. According to the SEC, this was in response to market concerns about the "quality, accuracy and reliability" of the reserves disclosures by the companies in the sector, information that the Alberta Securities Commission had already considered essential "to enable investors to make informed investment decisions."

A key innovation

As the authors show, the regulators achieved their goal. The key was redefining proved reserves as those that meet a minimum recovery probability threshold of 90%. This regulatory innovation remedied the vagueness of the previous regulations, which defined them as those "estimated as recoverable" in Canada and with a "reasonable certainty" of being recovered in the United States.

According to the authors, their study helps explain the effects of these new standards in an industry as important to the global economy as oil and gas. Furthermore, while their findings may seem specific to the United States and Canada, they also believe that they have implications for international regulators and those operating in other countries.

This is because their findings are "consistent with the notion that more rules-based standards enhance comparability," a conclusion that undoubtedly contributes to the current regulatory debate.

Methodology, very briefly

The authors studied a large sample of oil and gas exploration and production companies listed on the Toronto Stock Exchange, Toronto Venture Exchange, NYSE, Nasdaq and AMEX. The data are from 2002-2011. The data pertaining to Canada were furnished by CanOils Database, Alberta Securities Commission and SEDAR. Data from the United States came from Capital IQ, Evaluate Energy, the Securities and Exchange Commission as well as other sources.

Marc Badia and Gaizka Ormazábal acknowledge financial contributions from the Spanish Ministry of Economics, Industry and Competitiveness, grants ECO2010-19314, ECO2011-29533 and ECO2016-77579-C3-1-P. Miguel Duro acknowledges support from Columbia University CIBER.