IESE Insight

Search fund model takes root in Europe and Latin America

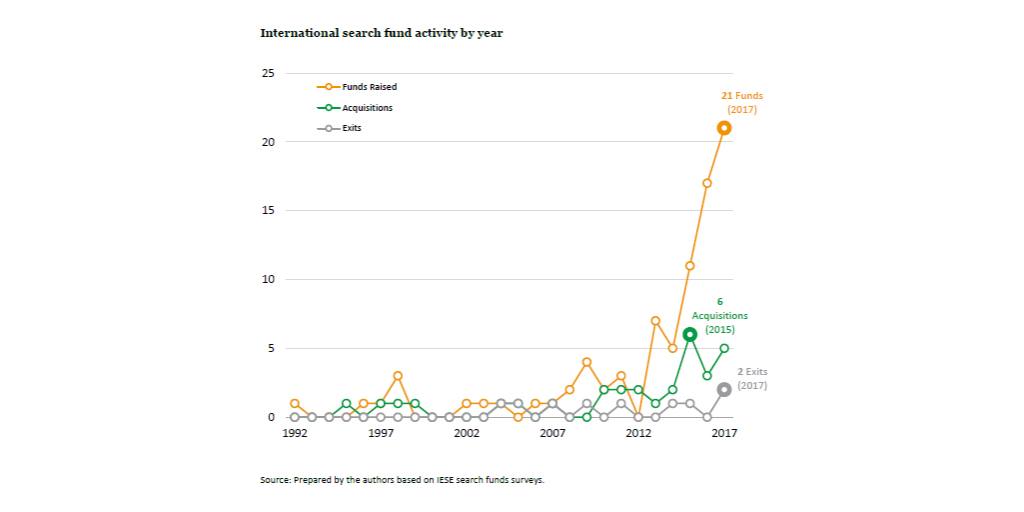

In 2017, there was a new peak of search-fund activity outside of the U.S. and Canada, with the founding of 21 new funds. Recent growth is especially robust in Continental Europe and Latin America, according to a 2018 biennial study of this investment vehicle.

Born in the United States, the search fund model is taking root and gaining momentum internationally — especially in Europe and Latin America — according to the 2018 study of international search funds conducted by IESE, working in close partnership with the Stanford Graduate School of Business.

In the 25 years since the search fund model initially crossed the Atlantic, a total of 83 first-time international funds — defined as those based outside the U.S. and Canada — have been tracked by IESE. Of those, a full quarter (21 funds) appeared in 2017 alone. In fact, 2017 was the third consecutive year to reach new heights of activity internationally. (See figure below.)

Momentum, yes, but visibility? It is still low. Surveys indicate that search funds remain relatively obscure as an asset class.

For those who don't know: the basic idea is that pooled capital from private investors allows a young entrepreneur — usually a freshly minted MBA — to search for, acquire, operate, and then exit a company, distributing any profits. For more information, see the publications and resources of IESE's Entrepreneurship and Innovation Center.

Because international funds are still relatively new, searchers spent more time raising funds and finding suitable acquisitions, surveys indicated. Of the funds tracked by IESE's study, 40 were still searching for attractive acquisition opportunities, 18 were operating an acquired company, nine had exited their acquisitions with positive returns to investors and three exited at a loss as of December 2017. Since there tend to be a four- to 10-year lag between acquisition and exit, more exits are expected as the funds mature in the years ahead.

While it's still too soon to draw inferences from the handful of international exits, Stanford reports the following global results: From 1984 to 2017, $924 million of equity capital was invested into search funds, generating "an aggregate equity value for investors of $5.7 billion (and roughly $1.5 billion for entrepreneurs)." Using "reasonably conservative assumptions," Stanford calculates that the aggregate pretax internal rate of return (IRR) for all search funds through the end of 2017 was 33.7% and the aggregate pretax return on investment (ROI) was 6.9x.

The changing map of search funds

Since search funds were invented at Harvard and popularized at Stanford, it's no wonder MBAs from U.S. business schools were largely responsible for the first international funds.

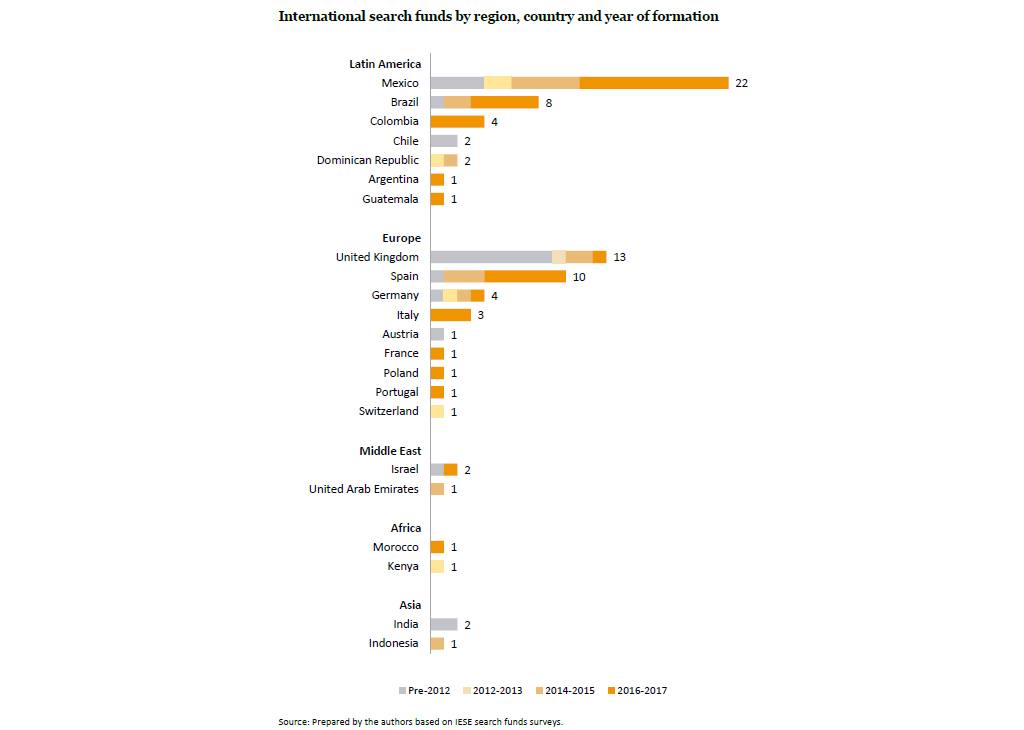

But now, more searchers speak Spanish — and many other languages, too. In IESE's 2018 study, eight new countries were added to the search map in just two years. That brings the total number of countries up to 22. Notably, between 2016 and 2017, there were 11 new funds in Mexico, six in Spain, five in Brazil, four in Colombia and another 12 in 10 different countries. (See figure below for the geographic distribution of all 84 funds.)

From MBA to search

Who are the international searchers? A full 90% of them have MBAs. And, of those, 69% have U.S. MBAs — although the study notes that 69% is notably lower than in previous studies. Their ages ranged from 26 to 43 years old. In Latin America, searchers' median salary was $95,000 while it was $84,000 in Europe. 73% raised their search fund within two years of their business school graduation.

Looking ahead to the next biennial report, the authors — Lenka Kolarova (IESE MBA 2011), Peter Kelly (lecturer at Stanford GSB), and professors Antonio Dávila and Rob Johnson — note that search activity remains strong in 2018. In fact, six new acquisitions have been noted for the first half of 2018.

Methodology, very briefly

This biennial study, undertaken in close partnership with the Stanford Graduate School of Business, targets all known first-time search funds outside the United States and Canada. It uses a quantitative, survey-based research method to look at the financial returns and other important characteristics of the 83 first-time funds identified through December 2017.