IESE Insight

Think gold? Alternative investments may help your portfolio

Don't invest in gold because you think the price will go up; invest to diversify and boost your portfolio when stocks and bonds are losing value.

During crises, when the stock market swoons, too many investors get fed up and sell (low). "And to add insult to injury," says professor Javier Estrada, "they do not get back into the market until the bull is raging, which means they buy high. Buying high and selling low does not seem to be the road to riches, does it?"

Well, no. So, according to Estrada: "A proper allocation to alternatives may help your portfolio when you need it the most: during volatile periods, and particularly during crises."

IESE's finance professor backs this assertion with empirical evidence, as he explains:

In recent research in the Journal of Wealth Management, I explored the role that an allocation to gold played in a portfolio during the last two crises: The bear market after the internet bubble (Crisis 1: August 2000 to September 2002) and the more recent global financial crisis (Crisis 2: October 2007 to September 2009). Consider a $100 investment at the beginning of each crisis (at the top of the market) and held through the end of each crisis (the bottom of the market) in three portfolios:

- 100 percent in stocks (S&P 500);

- 60 percent in stocks and 40 percent in bonds (60-40); and

- 40 percent in stocks, 40 percent in bonds, and 20 percent in gold (40-40-20).

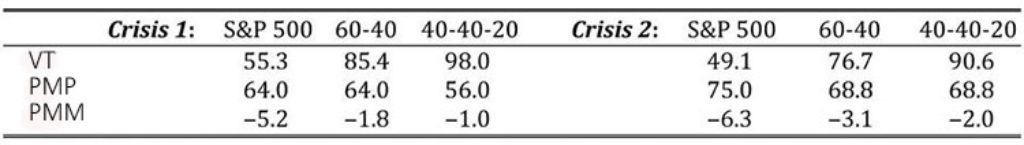

The exhibit below summarizes the performance of these three portfolios.

From "Investing: How Alternatives May Help Your Portfolio"

TV indicates the terminal value of these three portfolios, and as you can see, in both crises the portfolio with gold fell a lot less than the other two. In the first (second) crisis, stocks lost almost 45 percent (over 50 percent); the 60-40 portfolio lost almost 15 percent (over 23 percent); and the portfolio with gold lost only 2 percent (less than 10 percent).

Not only that, in both crises the portfolio with gold reduced both the proportion of months with losses (PL) and the average monthly loss (AL) in those months with losses. In short, when investors needed protection the most, gold played the valuable role of mitigating losses, and therefore investors' urge to sell (low!)

I finish with a caveat. Gold, and alternatives more generally, are somewhat controversial assets; whether they are beneficial to you depends on many factors that I have not addressed here. Consult with your advisor whether or not, given your goals, holding period, and tolerance for risk, alternatives belong to your portfolio.

See also, "3 Steps to Find the Right Investment Mix"