IESE Insight

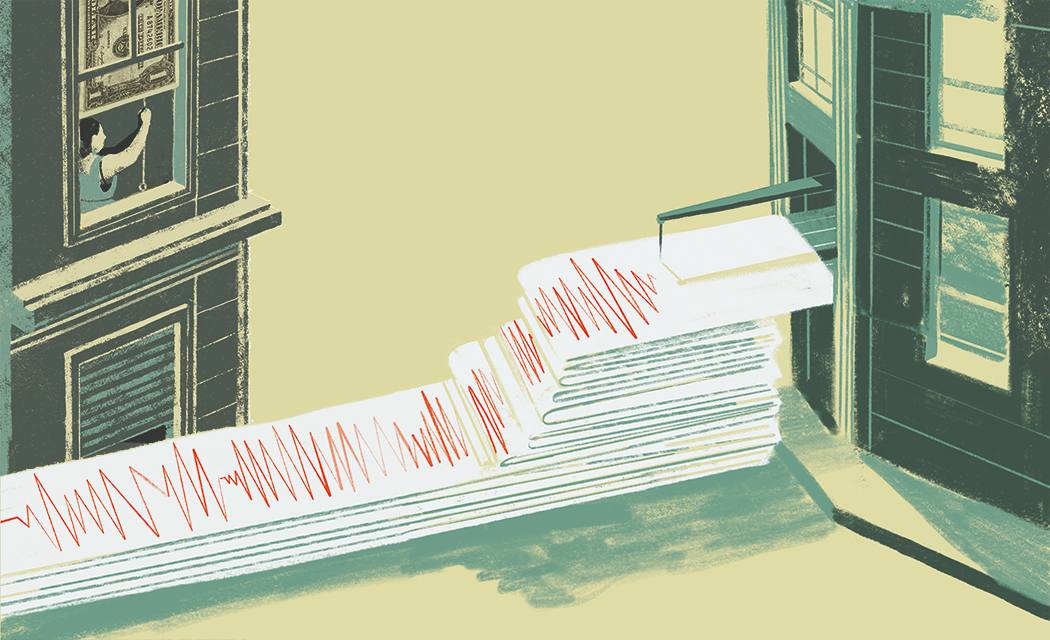

When morals meet models: ethics in banking

In the post-crisis order, more and more people are taking ethics in banking seriously. Here is how managers can take back control.

Whether it’s toxic derivatives, NINJA loans or fake Libor submissions, the ever growing list of Wall Street’s misdeeds has fueled financial reform debates. One thing is clear: if financial reform is to make real progress, morality needs to be brought back into finance. Yet, if presenting bank employees with a brand-new set of values — like being given a new corporate uniform to wear — is unlikely to alter their actions, what type of reform might avoid a repetition of the problems that led to the last crisis?

One solution is to employ more algorithmic risk-management models to constrain bankers’ ability to engage in unethical behavior. However, as I contend in my book — Taking the floor, based on a 16-year field study of a trading floor on Wall Street — relying on complex models to remedy the crisis of ethics on Wall Street poses many risks.

At worst, models aimed at improving the ethical function of banks may actually give rise to moral disengagement, leading to even more immoral conduct. But it doesn’t have to be that way, provided that banks and their regulators follow the steps outlined in this article.

Moral malaise

After decades of entrusting the elimination of financial misconduct to the exclusive care of the legal system, regulators on both sides of the Atlantic now seem to favor an approach that targets banking ethics. While some may not be pleased with this shift, the fact that people are now taking ethics seriously is a reflection of just how deeply the fallout of the last crisis has shaken the intellectual foundations of the financial industry.

For this latest effort not to end up as yet another well-intended but ineffective measure, there must be an accurate diagnosis of the underlying issues that fueled the crisis in the first place.