IESE Insight

Impact investor Marta Hervás: doing good while generating returns

Capital used to be on one side, and ESG on the other, like two diametrically opposed concerns. But according to Arcano's Marta Hervás, impact investing is bridging that divide. Here she explains the rise of this new asset class.

There is growing consensus that corporations must play a role in tackling the major challenges that society faces today. This requires changing the way we think about corporate strategic leadership.

To this end, IESE professor Fabrizio Ferraro ran a weeklong course on Sustainable Leadership as part of the Executive MBA. It featured case studies and guest speakers from various sectors and industries sharing their experiences of how they are integrating sustainability and Environmental, Social and Governance (ESG) criteria into their strategies and business practices. One such guest, Marta Hervás, addressed "Scaling Impact Investing."

Hervás is a Director at Arcano, a leading alternative asset manager headquartered in Madrid, Spain, with around 8 billion euros of assets under management and advisory. She leads Arcano's private equity (PE) impact investments globally and is also involved in defining ESG processes for PE and making sure these are implemented across investments.

Here she explains more about impact investing, a field which she says is growing like crazy.

Tell us a bit about Arcano...

Arcano was set up as a boutique investment bank catering to the mid-market, which Arcano felt was being overlooked by the broader industry. In 2009, a few years after launching its first PE "fund of funds" also targeting mid-market investments, the team began incorporating ESG into its investment process. Arcano was advocating ESG investing for well over a decade before interest took off among the Spanish investor community more widely. We were also the first independent Spanish alternative asset manager to join the U.N. Principles for Responsible Investment (PRI). After launching several successful ESG-committed funds, in 2018 we began considering launching an impact PE fund of funds when the concept of "impact investing" was still quite new.

Fund of funds, impact investing: please explain...

A fund of funds allows investors to build a portfolio of funds rather than a portfolio of stocks, bonds or other securities. Instead of an investor holding an individual security, he or she buys into a bundle of different funds that hold stocks or bonds, thus diversifying and spreading risks. These funds are managed by professional institutions and can be used to invest across asset classes. With impact PE, these funds tend to be thematic — only investing in specific sectors that support certain Sustainable Development Goals (SDGs) — or impact branded.

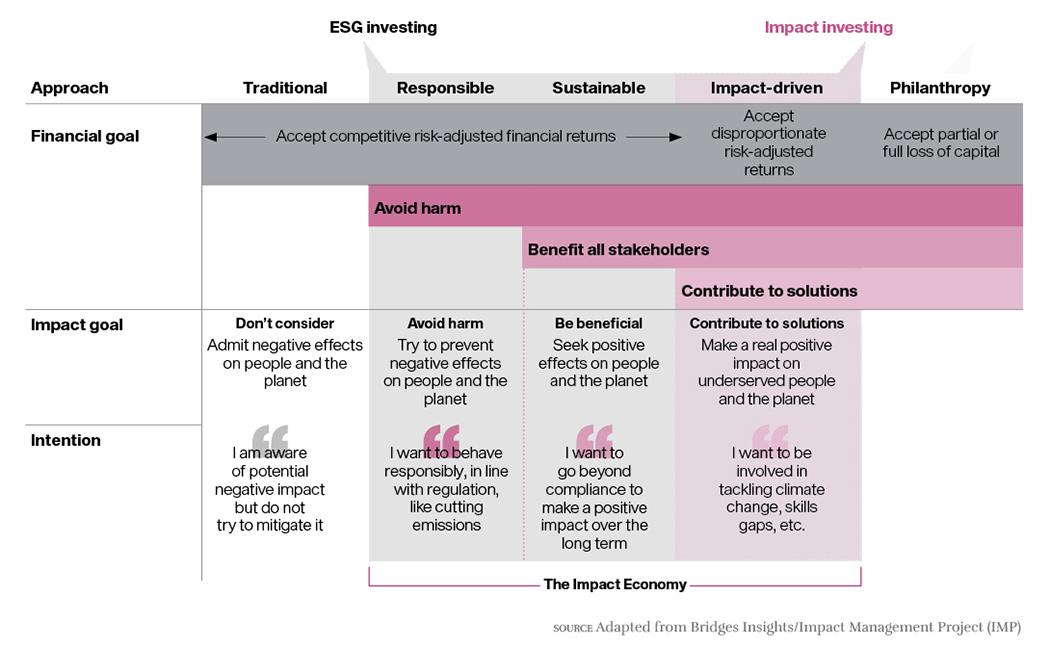

To understand the spectrum of investment, it helps to see the diagram below, with traditional investing at one end and philanthropy at the other. The broad "impact economy" lands between these two poles. It ranges from not wanting to do harm with your investments (so, using ESG criteria to screen out the negative companies) to wanting to do good by ensuring that the companies you invest in are making a real positive impact on underserved people and the planet, while generating financial returns. That would be "impact investing" more explicitly.

What was the initial response to your impact fund of funds?

There's a persistent belief that the only way to do impact investing is to sacrifice returns, but that's not the case, as we have proven. It really comes down to the individual investor. Different investors have different needs and priorities. Ultimately, if you don't see the value-add of limiting your investment scope to be able to generate some social advantage or solve some challenges in the social space, then impact investing may not be the right option for you.

We also find different reactions between the U.S. and Europe — the two main markets where we operate. In Europe, either because of investor interests or the regulatory environment here, there was generally a lot more knowledge about impact or ESG. Whereas when we started talking about this in the U.S., generally speaking asset managers were like, "Impact? What are you talking about?" Although that is now changing.

How do you make sure these funds stay committed to generating impact?

There are lots of ways to make sure that the funds and the underlying companies' management teams are aligned. For example, teams can have incentive structures where some fund managers link part of their carried interest to the achievement of the impact goals defined at the portfolio company level. And then, at the portfolio company, the management teams' incentive packages are also linked to the same impact KPIs. These are straightforward factors that can be analyzed and help investors understand the funds' level of commitment.

Having said that, you still need to probe deeper to understand if the intentionality for impact is there — if it's really embedded or intrinsically linked to the strategy. Let me give an example.

We identified a fund in the U.S. called Achieve Partners. They were launching a workforce education fund. Basically, they were investing in tech-driven companies and implementing "last-mile training models." One of the portfolio companies they had invested in was a healthcare IT company, helping healthcare organizations in the U.S. with their electronic health record (EHR) systems, including applying an EHR software in a more efficient way. It's a market where staffing is complex, as there is high demand for the service but not enough people trained to operate such software. By implementing the "last-mile training model" at the company, Achieve was able to offer the company's clients the trained professionals, who were capable of operating the software, in addition to their IT services. The cohort of professionals being trained traditionally had low levels of education. Through the intensive training process, sometimes reskilling or upskilling them, they were able to be placed within these healthcare organizations.

This is the full scope, from selling the product/service to investing in people, who can earn demonstrably more than they did before, and the healthcare providers become demonstrably more efficient than before. When we talked to Achieve, the term "impact investing" never came up in our initial conversations. Although they weren't marketing it as such, they were effectively doing what it takes to be considered impact investors. They saw a gap in the market, which represented a social challenge to be addressed, they solved it, and it was clearly having positive social outcomes. For us, this qualified as an impact fund. They had a defined strategy, they were able to measure their impact by the number of people trained and placed, they had diversity within those candidates and people coming from disadvantaged communities, they knew the increase in salary, and they could quantify the improvement and real outcomes.

A lot of our work starts by having conversations like these, spending time going through portfolios and figuring out what the underlying portfolio companies do, why it is impactful, what metrics can be reported, what management team incentives are in place, etc. All these analyses are time-consuming, complex and, as such, require a big effort. Our fund was created for investors who don't have the time, resources or know-how, and who are looking to access the profit-for-purpose impact space.

How do you prove that your investment is the one that is driving the change?

It's hard, but the way we handle it is to make sure there's a link between strategy and impact, like in the Achieve workforce fund case. We try to make sure that the decisions that we make are closely aligned with the managers and that the intention is there. We do our due diligence super thoroughly. After that, we need to monitor. If we feel that some managers are deviating from the path or strategy that they mentioned they were going to follow, we will try to provide feedback and guidance in order to redirect their focus. However, if the deviation continues, then we could potentially go to the secondary market and try to sell a position because it's not aligned with the original investment thesis.

Where do you see the most promising activity?

In general, we see four main impact investment themes covering most of the activity in our core focus markets of the U.S. and Europe: healthcare and wellbeing; the energy transition; quality education; and food and agriculture. Also, there is a lot of opportunity in emerging markets. However, for the time being, we are sticking to the U.S. and Europe, because that's where we feel comfortable that we can achieve impact returns with mitigated risks, although there are other funds of funds dedicated to emerging markets.

Given what's happening with inflation and the markets in general, how do you see the future?

To be honest, there are probably going to be even more retail investors interested in PE, many with an impact focus. The space has grown like crazy. When we started, we took a risk based on a strong conviction that you could generate positive social impact alongside attractive financial returns, and now we have proof. Everybody from general investors to pension funds seems to be moving in this direction, which means more awareness and more people willing to take the risk and launch more funds to do some good while generating returns.

Capital used to be on one side, and social and environmental were on the other, like two diametrically opposed concerns. But ESG and impact investing have bridged that divide. And just as it is getting increasingly difficult to find a corporate leader today saying, "I'm just the CEO, I only take care of business," likewise fund managers are expected to have some basic understanding of social and environmental issues, and make decisions based not only on metrics like potential return on investment but also on return on impact. Which isn't to say that risk-return won't ever be justified, just that more and more people are landing somewhere in between.

MORE INFO

The case study "Arcano Partners: scaling impact with a fund of funds" Parts A (SM-1713-E) and B (SM-1714-E), by Nicolas Mo Umpierre (MBA 2022) and Fabrizio Ferraro, is available from IESE Publishing at www.iesepublishing.com.

A version of this interview forms part of the magazine IESE Business School Insight 162.