IESE Insight

Nine out of 10 foreign companies renew their commitments to Spain

Nine out of every 10 foreign companies in Spain expect to increase or at least maintain their investments, staffing levels and business volume over the next three years.

Continuing a promising trend first seen in 2014, foreign companies remain bullish on Spain in 2015, shedding the doubts that had emerged in previous years' surveys. In fact, over 90 percent of the companies polled plan to maintain or increase their investments, staffing levels and business volume in Spain between 2015 and 2018. The country's business climate is rated 2.9 out of 5 overall, rising from 2.7 in the previous year.

These are some of the findings of the eighth edition of the Barometer of the Business Climate in Spain, prepared by IESE's International Center for Competitiveness (run by Emeritus Professor Antoni Subirà) in conjunction with ICEX-Invest in Spain and Multinacionales por marca España, an association that works with multinationals to promote Spain as a brand.

Great expectations

Overall, more than 500 companies surveyed confirm the previous year's optimistic forecasts and report that they expect further improvements in all aspects analyzed — including how much they invest, what they expect to bill, their hiring needs and exports levels. More specifically:

- Investment prospects are very positive: 94 percent of the foreign companies surveyed plan to maintain or increase their levels of investment in Spain during 2015, a percentage that reaches 95 percent looking ahead to 2016-2018.

- Healthy hiring ahead: The percentage of companies expecting to either maintain or increase the number of employees in Spain grew from 87 percent in 2014 to 91 percent in 2015. That percentage grows to 95 percent of companies planning ahead for 2017-2018.

- In terms of sales or business volume, 64 percent of companies expect to see it increase this year. Only 9 percent expect it to slow down in 2015 and only 4 percent predict a drop for 2017 to 2018.

- Although export enthusiasm is more muted than other areas, businesses do expect exports to evolve positively. In fact, only 2 percent of foreign companies exporting from Spain expect volumes to drop in the years ahead.

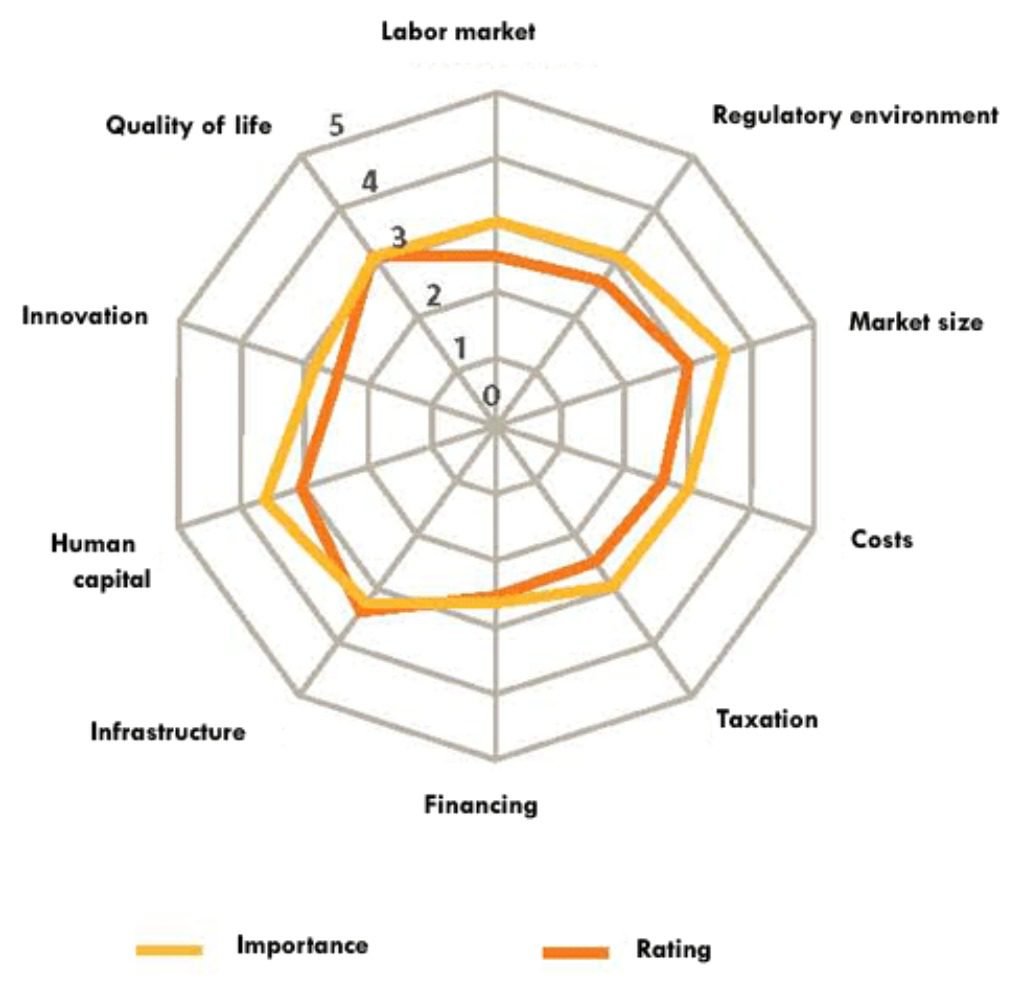

Strengths and weaknesses of the Spanish market

For foreign investors, Spain's areas of strength remain its infrastructure, quality of life and available human capital, followed by its market size, echoing last year's results.

The weak points remain Spain's taxation system and climate for innovation, although these may not be the most relevant areas for foreign companies working on Spanish soil.

Spain's infrastructure strengths include its airports, high-speed railways and highways. In terms of human capital, companies appreciate both the availability of unskilled labor and the quality of Spain's business schools. For quality of life, Spain's public safety, its leisure and cultural activities as well as the quality of its health system are hailed in survey responses.

Meanwhile, electricity costs are highlighted as the country's main weakness for businesses, the same as seen last year. This is followed by the level of investment in R&D, the bureaucratic burden on businesses, social security contributions for workers, getting visas and applying value-added tax (VAT) and special taxes on products and services.

Room for improvement

Although Spain's human capital earns high ratings from companies overall, the survey says there is more room for improvement. Language skills, capacity for learning and the acceptance of responsibilities and objectives are priority areas, because in these areas you see a gap between corporate expectations and the reality on the ground.

Is the recovery a given?

Currently, Spain is the fastest growing among the larger members of the European Union. It has clocked two years of continuous growth and forecasts predict growth rates will surpass 3 percent in 2015.

If confirmed, these numbers add up to economic recovery, an expanding local market and increasing attractiveness to foreign investment.

According to Spain's Ministry of Economy and Competitiveness, productive foreign investment had already grown about 10 percent to nearly 18 billion euros in 2014.

This places Spain as the ninth largest recipient of foreign direct investment in the world, with a stock of more than $720 billion, according to UNCTAD, moving up two positions in a year.