IESE Insight

Who's afraid of Shein?

Spain’s fashion industry has changed more in the last two years than in the 25 years before that, as online retailer Shein became the third most important retailer in the country. Discover this and other trends in Spanish fashion.

- Fashion industry sales are slowing down in Europe. In Spain, the top clothing retailers’ sales jumped 17.5% from March 2021 to March 2022, but climbed a more modest 7.5% from July 2021 to July 2022.

- Physical stores are losing customers. Online sales, on the other hand, surged 28% from July 2021 to July 2022.

- When a Zara store closes, buyers turn to options in neighboring areas and online. When a Primark store opens, bargain seekers are attracted to the area. The arrival of Shein cuts competitors’ sales online and off.

For the first time in fashion history, a newcomer has risen to become one of the top three retailers over the course of a mere nine quarters. This newcomer is Shein, a brand that is taking sales away from its competition online and off.

This is confirmed by a recent study of Spain’s fashion industry, the Barómetro Fintonic Intent HQ (in Spanish). It’s led by José Luis Nueno, holder of the Intent HQ Chair on Changing Consumer Behavior at IESE, and Alfonso Urien, director of the Data Insights Center at IESE and Intent HQ. In the report, Nueno and Urien analyze fashion consumption between 2020 and 2022 based on data from nearly six million transactions carried out by 237,000 customers registered with the Fintonic expense tracking app in Spain.

The study reveals important trends, such as a recent slump in sales for the main shopping streets and centers, along with the growing importance of the online channel — especially in small cities, where its relative weight is increasing.

More online, less off

In Spain, fashion retailers’ sales grew by 17.5% between March 2021 and March 2022. However, between July 2021 and the same month in 2022, they increased by a more modest 7.5%. And from August, year-over-year sales grew by an even slimmer 5.7%. That is to say, growth rates are flattening out. The same pattern is seen in the United Kingdom and elsewhere in Europe.

Sales in physical stores are slowing down the most. Year-over-year growth for the first half of 2022 was 19.7% offline, but then flattened out over the summer months. Main street stores lost out during lockdowns and then experienced some recovery. But these shops can’t keep up with online options, which grew 28% between July 2021 and July 2022, and 18.3% from August 2021 to August 2022. For their part, shopping centers have more customers, but those customers are making fewer transactions.

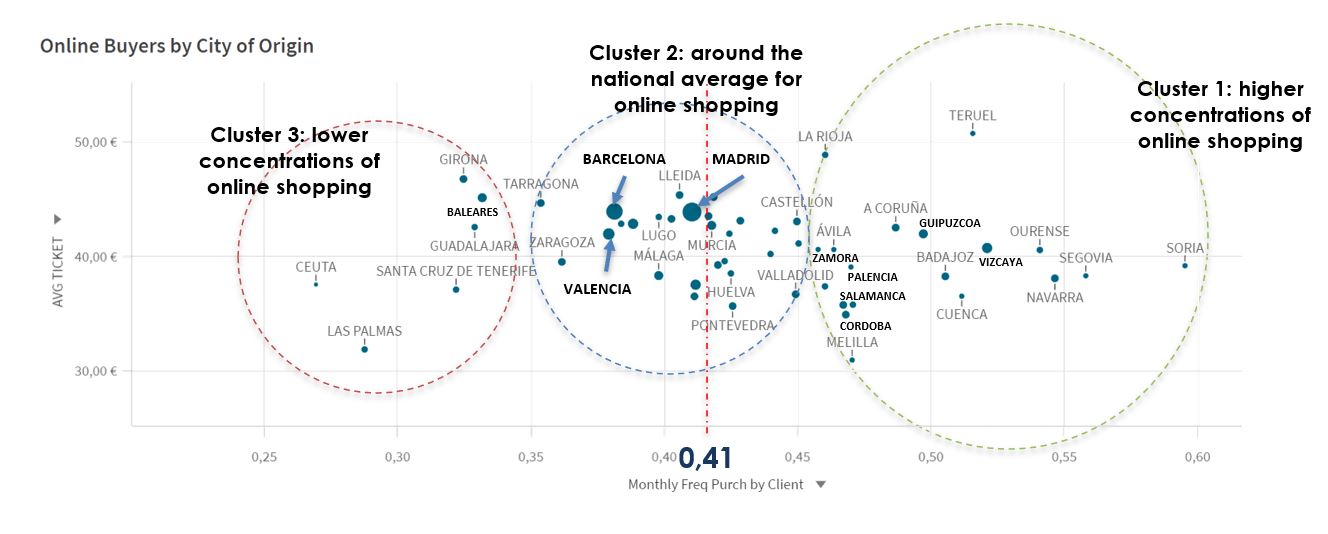

Small cities are where to find the greatest concentration of e-commerce activity. Consumers who lack immediate access to stores can go online. Retailers would be wise to think carefully about their sales strategy in these areas, because of their potential support for innovative shopping options (see “Online buyers by city”).

Source: El comportamiento del sector de la moda en 2022: Barómetro Fintonic Intent HQ

An Achilles’ heel of online shopping is returns. On average, a third of purchased products are returned, a cost borne by merchants and a drag on e-commerce. However, there may be a change of trend: Zara has begun charging for returns and several other operators will likely follow suit.

Zara, Primark and Shein on the winners’ podium

In the Spanish fashion sector today, single-brand clothing empires dominate. For women, Zara and Primark lead sales across all channels, while the Shein online store ranks third in terms of sales, fourth for number of transactions and fifth for number of customers. H&M also features in the top 5.

Male shoppers, meanwhile, are more likely to shop for sportswear, such as Nike or Adidas, or more formal menswear (Spanish brand Cortefiel). But Shein is also well positioned to enter this market.

When it comes to online-only sales, Shein is the leader, followed by Zara, Zalando, H&M and Asos. Across all three geographical clusters (those who shop online more than average, the average amount, and less than average), Zara, Shein and Zalando hold one of the top three spots, followed by Asos and H&M. Outside the top five, the rankings are more variable.

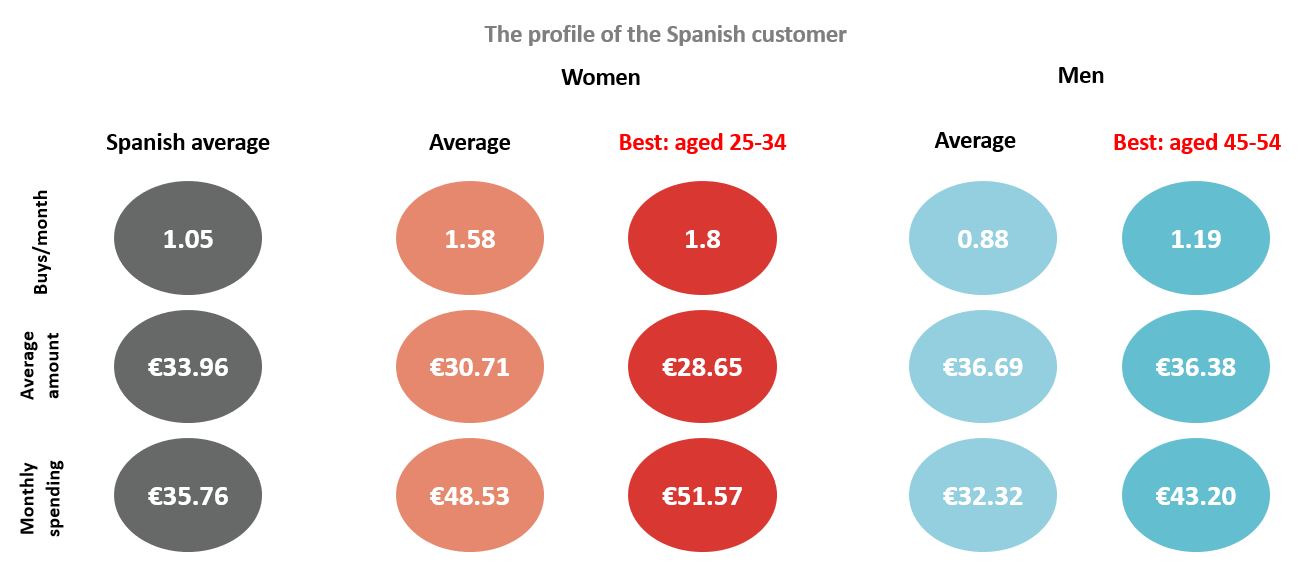

The sales seasons significantly affect the clothing retail sector. Spending during the sales was 11% higher in 2022 than in 2021, with customers spending an average of €30 per transaction in the winter sales, and €29 in the summer sales. Black Friday is the campaign that generates the most sales: in 2022 the average shopper spent €254 and made 5.95 purchases in different stores, equivalent to about €42 per transaction. This is significantly more than the €35.76 spent per month by the average shopper.

Women spend above the average, at €48.53. The demographic group that spends the most is women in the 25-34 age bracket, whose monthly spending is €51.57. The highest spending male customer is in the 45-54 bracket, and spends €43.20 per month, over 30% more than the male average.

Source: El comportamiento del sector de la moda en 2022: Barómetro Fintonic Intent HQ

Focusing just on online sales, young people are unsurprisingly the most represented, particularly women aged 18-34. The male online shopper is most likely between 35 and 54 years old, with 45-54 once again a significant segment — a distinction that brands should keep in mind.

How the big 3 can make or break the neighborhood

The leading brands carry so much weight in the fashion sector that opening or closing a store can have knock-on effects on consumer behavior and competition.

The Zara effect: The Inditex heavy-hitter is a leader, in part, thanks to its development of the omnichannel model. In the past decade it has invested €2.7 billion in logistics and procurement to unify its inventory, connect with suppliers and monitor stock. It also closed 890 physical stores between 2019 and 2022. When a Zara store closes, there is a significant drop in sales and transactions in the area. The buyer relocates online or to another physical Zara store, a reminder that shopping centers and main streets require strong anchor stores to attract consumers.

The Primark effect: When a Primark store opens, buyers are attracted to the area by the ultra-low-cost offering. This prevents consumer flight to suburban centers and thus also benefits shops in the surrounding area.

The Shein effect: Except for temporary pop-up shops, Shein has no physical stores at all. Even so, when buyers turn to Shein, they reduce their purchases from other brands, both online and off. And given the number of buyers flocking to Shein, the impact on competition is not insignificant.

About the study

The information gathered here is based on data from 5.76 million transactions recorded by Fintonic, a Spanish app for managing personal finances. The transactions were collected over 607 days and account for €198.4 million spent by 237,000 customers around Spain between January 2020 and September 2022. Analysis took participant income level and payment method (except cash) into account.

MORE INFO:

Read the report on the Retail Revolution published in IESE Business School Insight 162 (Sept.-Dec. 2022).

Access the study (Spanish only)