IESE Insight

Where do we go from here? Economic scenarios

How will the economic impact of COVID-19 be felt? With so many unknowns, simulations based on varying assumptions can help leaders prepare for whatever might be next. Here are a few things to look at for the year ahead.

By Núria Mas

Back in January, 2020 was expected to be a recovery year, with 3.3% global GDP growth, according to International Monetary Fund (IMF)'s forecast. But because of the coronavirus outbreak, projections made in April are very different, with a 3.0% contraction in global GDP predicted for 2020.

Trillions of dollars have disappeared in these revised global estimates. But what does that really mean to managers on the ground for the months and years ahead?

Of course, no one can really know right now, but building out economic scenarios can help us prepare. Simulations based on what health experts and institutions are saying can help decision-makers make better informed plans for the short and medium term.

Keeping in mind that COVID-19 is fundamentally a health crisis, containment policies are critical so as not to overwhelm healthcare systems and cause an excess of unnecessary deaths. That said, the likely economic impacts of various containment policies are basically a mirror image of the impacts on health outcomes. In other words, the more containment, the more economic damage, and the longer containment policies last, the longer the economic damage continues. It is very hard to get the balance right.

The case for scenario building

So, what might the latest IMF's estimates for 2020 look like on the ground? While the global estimate is for a 3% contraction, Spain and Italy, for example, are expected to experience 8% and 9% drops in GDP, respectively. To get a more granular view over time, simple, back-of-the-envelope-type simulations can show us more.

In one scenario for Spain, for instance, we might see a dramatic plunge in business activity for the spring followed by a recovery in the fall. That v-shaped scenario follows the prediction that schools and businesses reopen by September. But a second simulation looks at what might happen if the lockdown is eased over the summer, but then there's a second wave of infections in the fall, as there was with the Spanish flu a hundred years ago. In the second scenario, Spain's economy might contract by 13.5% and point to further damage in 2021. The average unemployment rate throughout the year might be almost 5 percentage points higher.

In my view, the prediction numbers don't say much per se. That's why an exercise to keep us thinking about what might come next is helpful. We can build scenarios to consider the unknowns. E.g., we still don't know if people are immunized after having been exposed once or if a treatment will soon makes things better. As institutions like the IMF publish estimates, business leaders should work with them to get a better idea of what assumptions underpin the number and so what they really mean.

Other considerations: Will the crisis exaggerate problems of income inequality?

The International Labor Organization (ILO) predicts working hours in the second quarter will decline by 6.7% globally -- the equivalent of losing 195 million full-time jobs.

In the short term, many say existing problems of income inequality are likely to be exaggerated. A sizeable number of the jobs that are shutting down are lower paid jobs. Those who can more seamlessly transition to teleworking tend to be knowledge workers in better paid positions, so that puts pressure on income inequality.

But there might be some good news in the longer term. I saw a working paper from the Federal Reserve of San Francisco in which economists look back at 15 major pandemics spanning from the 14th century. The paper finds some evidence that two things could happen and persist for decades: 1) interes

t rates staying very low (thus lowering the cost of capital for governments in their bailouts) and 2) real wages rising a bit and remaining somewhat elevated, perhaps due to labor scarcity. So income inequality might actually be reduced in the longer term.

Any other bright spots?

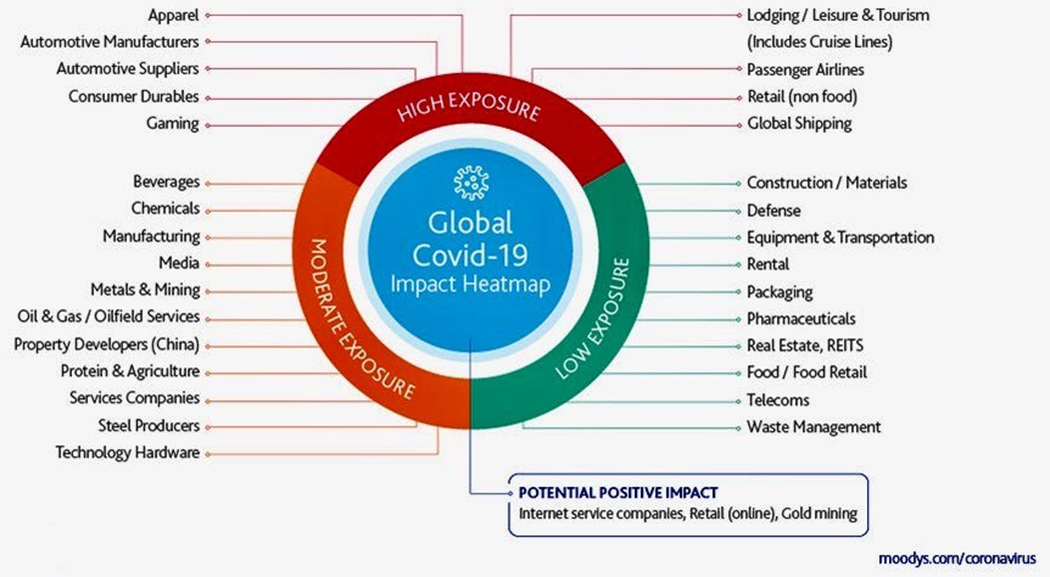

What are the predictions for the impact of coronavirus on various sectors of the economy? I've seen a heat map created by the credit rating agency, Moody's. Here there are many losers, but also a few winners. Among the very hardest hit industries are airlines, apparel and automotive. There are also negative impacts seen for oil and gas, manufacturing and media. And although everyone is buying groceries, the food industry is even suffering amid restaurant closures as well as tighter budgets at home. For a glimmer of positive impact, look to gold mining, internet services and online retail. (See figure.)

Source: Moody's Investors Service

MORE INFO

"Where do we go from here? An economic perspective" with Núria Mas, which served as the basis for this article.