IESE Insight

How large is the disruption in banking?

Profitability concerns, fintech growth and the potential reach of Big Tech are reshaping banking. The case of China, where Alibaba's Ant Financial is permeating almost every aspect of consumers' lives, exemplifies this digital disruption.

By Xavier Vives

A decade ago, the world's 10 largest banks by assets were based in Europe or the United States, whereas today the top 10 are dominated by six Asia-based banks. The reason for this shift can be traced not only to the crisis and the rise of Asia, but also from the consequences of the crisis and digital disruption triggered by increased competition in retail from financial technology (fintech) and platform-based competitors.

The profitability of the sector has been threatened as a result, with European and Japanese banks barely covering their cost of capital. A legitimate question is what the top-10 list will look like in a decade. Note that the capitalization of large technology companies like Amazon or Google dwarfs that of major international banks. The following figures offer an idea of the scope of disruption in the global banking industry (for those interested in delving deeper, please see "Digital Disruption in Banking", published in The Annual Review of Financial Economics).

1. Banks are less profitable

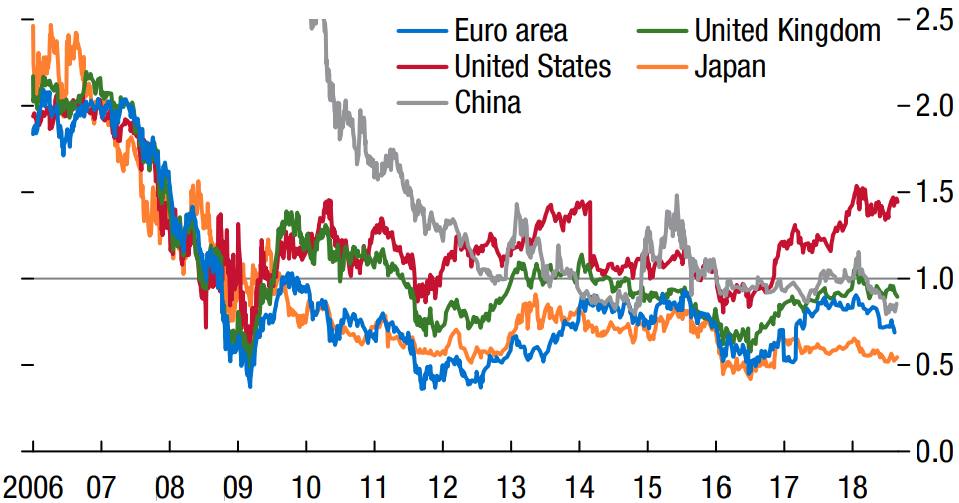

The banking system is still struggling to recover pre-crisis levels of profitability. The sector's weakness stems from numerous factors and the way they interact: deleveraging and the burden of legacy assets from the crisis, low interest rates that stay low for a long time and the threat of new technologically savvy entrants, in addition to increased compliance and regulatory costs. As shown in Figure 1, bank aggregate price-to-book ratios in major economies are less than 1.0, with the exception of the United States. This reflects that, in these countries, the market discounts very low profitability for banks in terms of the market value of equity compared to the amount of capital booked on their balance sheets.

Figure 1. Bank price-to-book ratios

Source: IMF Global Financial Stability Report (2018).

The question is whether banking will ever go back to pre-crisis profitability levels. Digital technology may have a large impact in terms of increasing competition and contestability of banking markets. Banking is moving towards a customer-centric platform-based model and incumbents will have to restructure.

2. The impact of digital disruption

The industry is facing a deep restructuring in a context of low interest rates and profitability, particularly in the eurozone and Japan. The speed of adoption of new digital technologies in finance and the acquisition of users associated with them has accelerated markedly. Indeed, the major change now in the banking sector is emerging from digital disruption, which is leaving incumbents with potentially obsolete legacy technologies (e.g., mainframes) and overextended branch networks to serve the higher standards of service that new competitors can provide. Customers have new service expectations in terms of user-friendliness of the interface and transparency. In Asia and Africa, technological leapfrogging has extended banking services to previously unbanked segments of the population.

Digital disruption in the financial sector is driven by factors both on the supply side -- mostly technological developments -- and on the demand side, with new consumer prospects regarding service. On the technological supply side, relevant factors are internet application programming interfaces (APIs), cloud computing, sm

artphones, digital currencies and blockchain technology.

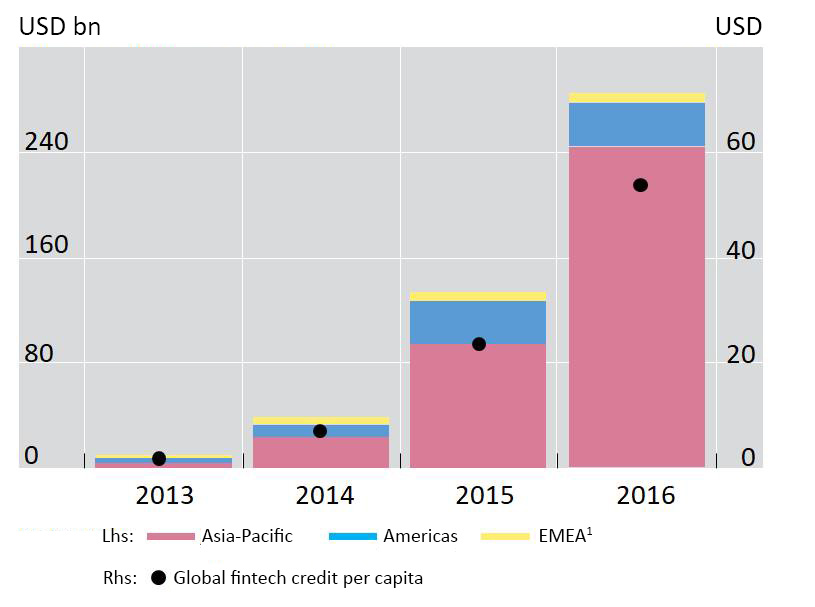

Fintech credit (that is, online credit not operated by established commercial banks) has grown rapidly since 2005. In recent years, available data show that fintech credit activity has expanded quickly in many countries, albeit from a very low base. As shown in Figure 2, about $284 billion in such credit was extended globally in 2016, up from $11 billion in 2013. In absolute values, the volume of online credit is larger in some economies, notably China, the United States and the United Kingdom. However, despite solid growth, fintech credit represents a very small share of overall credit flows in most jurisdictions. In China, it was up to 13% of overall new lending in the first half of 2018.

Figure 2. Global volume of new fintech credit

Source: Claessens et al. (2018). Note: 1 Europe, Middle East and Africa.

Overall, the fundamental advantage of fintech firms is that they have a leaner business model. Unencumbered by rigid legacy systems, they benefit from state-of-the-art technologies that deliver a fast and flexible response to changing consumer preferences. They provide a mobile customer experience centered on banking activities with higher returns on equity (ROE) such as payments, financial advice and distribution of financial products. Last but not least, fintech companies are able to attract young, bright people to their talent pool.

In contrast, the absence of an installed, loyal customer base; limited access to soft information about potential customers; a comparative lack of reputation and brand recognition; and a relatively high cost of capital are challenges that fintech firms must try to overcome. That said, the major threat of disruption may come from Big Tech (i.e., large technology companies that expand toward the direct provision of financial services or products).

3. The competitive advantage of Big Tech

Big Tech platforms enjoy most of the advantages of fintech firms with practically none of the drawbacks. They have an established, loyal customer base and large quantities of customer data; a strong reputation and lobbying capacity; strong brand names; an ability to exploit network effects; and the capability to fund their activities with a low cost of capital. In particular, Big Tech platforms have access to valuable business data and can leverage their scale to provide financial services at a lower cost at high volume.

Big Tech platforms focused on internet search (e.g., Google) gather information about customers from search activity; those focused on social media (e.g., Facebook) have direct personal data on users and their connections; and those focused on e-commerce (e.g., Amazon) have data on both sellers and buyers and their habits. The complementarities of Big Tech businesses with financial services will depend on the type of data gathered. For social media and search companies, data will help with the distribution and pricing of financial services, while for e-commerce platforms, data will facilitate credit assessment.

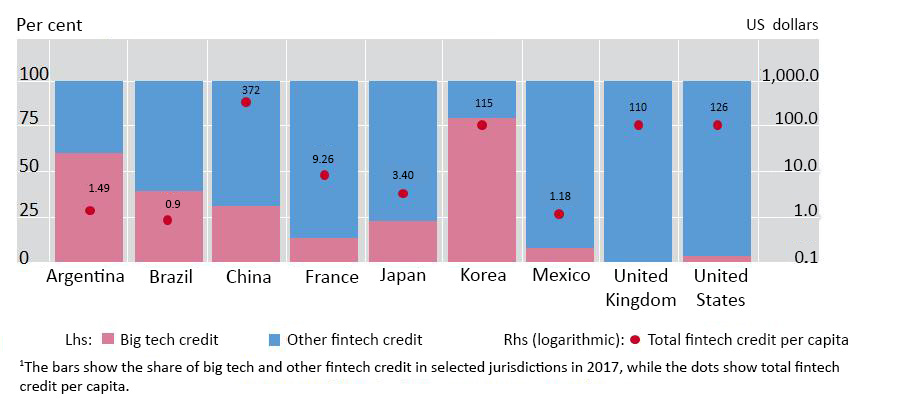

Big Tech companies initially made inroads with payments services, and in some jurisdictions, expanded into lending and other financial products, either directly or with financial institution partners. In Figure 3, we see that the volume of Big Tech credit relative to total fintech credit ("loan-based alternative finance") varies greatly across economies. It is at its highest in South Korea, Argentina and Brazil, each of which has a relatively small fintech credit market. China is the world's largest market for fintech and Big Tech credit, both in absolute and per capita terms and, interestingly, the share of Big Tech credit i

s only 20%. Finally, the share of Big Tech credit is very small in the more-developed financial markets of the U.S. and the U.K. The question is how much will it grow and whether this will happen in partnership or in competition with established incumbents.

Figure 3. Big Tech and other fintech credit in selected jurisdictions (1)

Source: Frost et al. (BIS WP no 779, 2019).

4. The case of China

China exemplifies the large effect that fintech and especially Big Tech firms can have on the banking sector. Its mobile-based connectivity ecosystem, along with the scarcity of consumer-targeted bank offerings and an innovation-friendly regulatory framework, has allowed large tech companies to seize large market shares. P2P lending and mobile payments are well developed in China. Big Tech firms' financial activities include mobile payments for consumer goods. Such payments have become increasingly popular and currently constitute 16% of China's GDP (versus less than 1% of U.S. and U.K. GDP).

In 2003 and 2004, Alibaba, China's most prominent online commerce company, took advantage of the underdeveloped payment system by introducing Alipay as a third-party online payment platform. As part of Ant Financial, Alipay has been instrumental in Alibaba's success. It now offers payments, wealth management, lending, insurance, and credit-scoring services, has more than 520 million users and manages money at the same level as China's big four traditional lenders. The platform now covers more than 50% of the Chinese mobile payments sector and its only major competitor is the tech giant Tencent (which owns the dominant messaging and social network app WeChat). Together these two firms control 94% of the market. The total value of e-money transactions in China exceeds that of Visa and MasterCard combined worldwide.

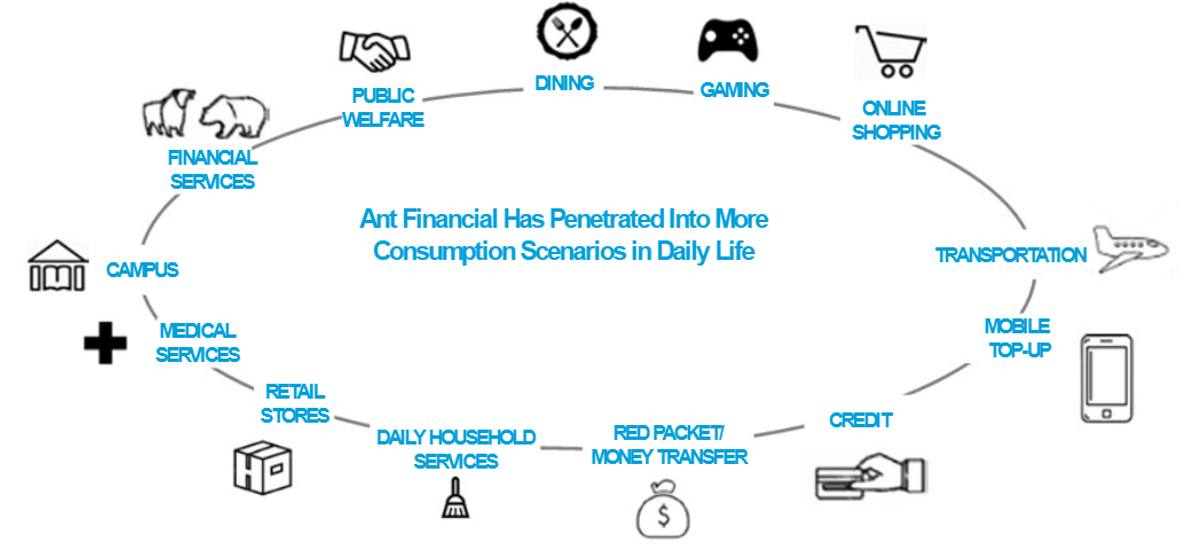

Ant Financial is responsible for coordinating the management of all the group's operations in the financial sphere. As depicted in Figure 4, the largest fintech in the world has infiltrated everyday life. Ant Financial's success is the result of leveraging the ecosystem: fulfilling customers' needs and increasing financial inclusion in both urban and rural areas, SMEs and individual customers by applying the most advanced technologies to generate dynamic data in several business sectors and collaborating with local partners through technology transfer.

Figure 4. Ant Financial ecosystem

Source: Citi, Bank of the Future report (2018).

Evolving consumer expectations, technological innovations, regulatory changes and new business models will all play a role in shaping the global banking system. What will the bank of 2030 look like? Only time will tell.