IESE Insight

How do 125 markets for private equity measure up?

The United States tops the 2016 ranking by the Venture Capital and Private Equity Country Attractiveness Index. The United Kingdom comes 2nd and Canada 3rd out of a ranking of 125 private equity markets.

In the 7th edition of the Venture Capital and Private Equity Country Attractiveness Index, the United States tops the charts once again, offering the world's most attractive conditions for investment in venture capital and private equity assets. The United Kingdom and Canada place 2nd and 3rd, respectively, completing the English-speaking winners' podium.

Joining them to make up the top 10 are: Singapore (4th), Hong Kong SAR (5h), Australia (6th), Japan (7th), New Zealand (8th), Germany (9th) and Switzerland (10th). Notably, four distinct regions are represented in the top 10: North America (two), Western Europe (three), Asia (three) and Australasia (two). The 2016 results are based on weighted indicators covering six key drivers relevant to venture capital and private equity (VC/PE) investors.

Expanding global coverage

What started as IESE's pilot study of European countries in 2006 has expanded significantly over the years to become an increasingly useful tool for international investors. The 2016 VC/PE Country Attractiveness Index, designed and elaborated by IESE's Center for International Finance, working in conjunction with EMLYON Business School, now ranks 125 economies around the globe for useful comparisons. Five new countries were added last year: Sri Lanka (at 57th), Qatar (68th), Lebanon (79th), Bolivia (101st) and Azerbaijan (104th), with data tracked back to watch five-year trends in their rankings.

Economies are analyzed according to hundreds of thousands of data points covering six key drivers:

- Economic activity, including GDP, expected real GDP growth and unemployment.

- Depth of capital markets, including IPO and M&A activity, debt and credit markets, and financial market sophistication.

- Taxation, including incentives for entrepreneurs and the ease of filing.

- Investor protections and corporate governance, including legal protections.

- Human and social environment, including education, labor regulations and corruption measures.

- Entrepreneurial culture and deal opportunities, including indicators of innovation, corporate R&D, and the ease of starting, running and closing a business.

While helping investors spot emerging market winners and assess risk/reward profiles around the globe, the index may also help local regulators set or revise policies in order to better attract VC/PE money in the future.

U.S. is the benchmark

The United States, ranked 1st once again, thereby serves as the index benchmark. Particularly notable are the U.S. entrepreneurial culture and deal opportunities as well as the depth of its capital markets, for which it consistently ranks 1st. The country also scores near the top for its economic activity, human and social environment, and investor protections.

The only key driver for which the United States is not ranked in the global top 5 is taxation. In fact, 51 economies have tax practices that are more favorable to entrepreneurs.

Five-year trends

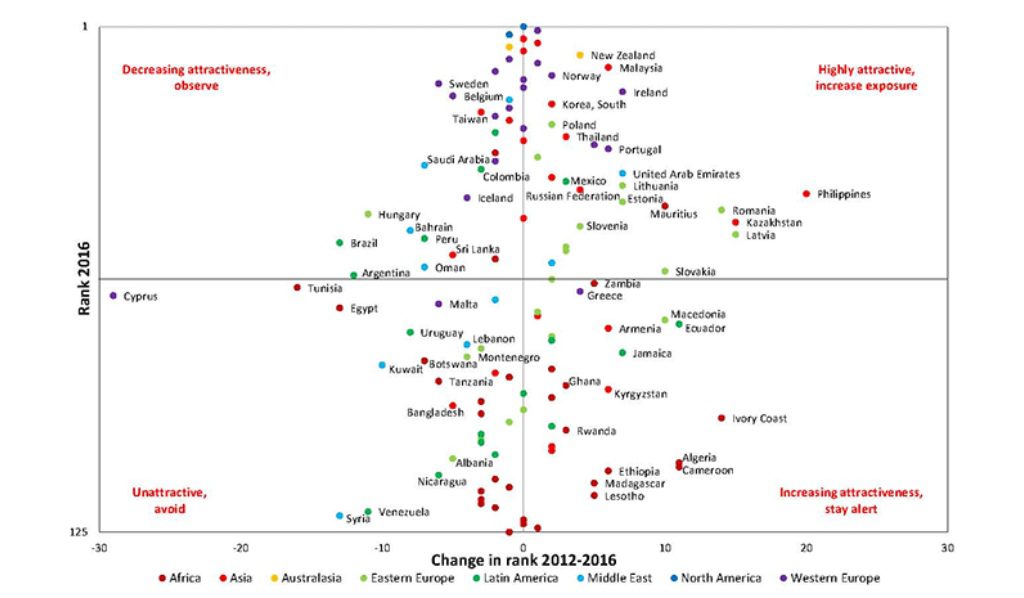

The index creators prefer not to read too much into year-to-year changes, which may stem from short-term volatility in some indicators. Instead, they highlight five-year shifts, since private equity tends to be handled by long-term institutional investors in the first place. To this end, the index is accompanied by an interactive website to view five-year trends and regional shifts.

Among the biggest five-year movers is the Philippines, which has ascended 20 places to land at 42nd. The two key drivers of this change are its economic activity and increasingly sophisticated capital markets.

Positive trends are also seen in Kazakhstan and Latvia, both up 15 places in five years to rank 49th and 52nd, respectively.

The biggest five-year losers in the ranking were Cyprus (down 29 spots to 67th), Tunisia (down 16 spots to 65th), Brazil, Egypt and Syria (each down an unlucky 13 places to 54th, 70th and 121st, respectively).

Of the famous BRICS (Brazil, Russia, India, China and South Africa), Brazil ranks as the least attractive at 54th, behind the Russian Federation, which has climbed to 41st. China is still the powerhouse of the group at 24th, but India is gaining ground, now at 29th. South Africa is Africa's top performer at 32nd place overall.

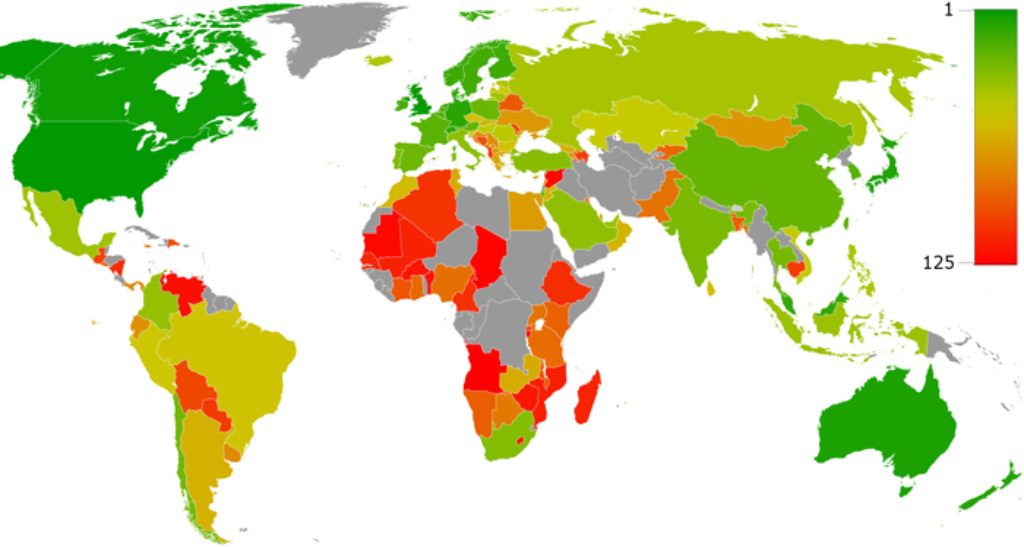

Heat map 2016

To help track region trends, a heat map accompanies the index, with red indicating caution and green signaling a high ranking.

Africa has many red spots and incomplete coverage but there are trends of interest to potential investors. This year, the small island nation of Mauritius has overtaken Morocco as Africa's second most attractive investment destination. Now ranked 45th overall, Mauritius improved investor protection and corporate governance practice as well as its economic activity.

In the green, Western Europe accounts for almost half (14) of the ranking's top 30 — from the United Kingdom (2nd) and Germany (9th) to Spain (26th) and Luxembourg (30th). Of the 20 economies in West Europe tracked, Cyprus (67th) and Malta (69th) are the region's laggards.

Eastern Europe is a mix of hues, with its top performer, Poland, ranked 25th. So is the Middle East, with a green Israel ranked 19th. Over in Latin America, Chile stands out at 27th.

The graph below shows which countries are the most attractive and which should be avoided:

To achieve a high ranking on the VC/PE Country Attractiveness Index, a country must score well on all six key drivers, the creators note. The index team is led by professors Heinrich Liechtenstein of IESE and Alexander Groh of EMLYON, and IESE alumni Karsten Lieser and Markus Biesinger.