IESE Insight

Corporate venturing: how to boost speed while reducing costs

When can you expect results? How much does each opportunity cost? Over 120 innovation executives shared their corporate venturing experiences. The results are compiled in a study that can help debunk common myths and benchmark your firm's performance.

Corporate venturing — the collaborative framework between established corporations and innovative startups — continues to emerge at speed. Well known adopters now include AT&T, Schneider Electric, Intel, Qualcomm, Samsung, Henkel, Comcast, Wells Fargo and 3M. These major companies are applying corporate-venturing mechanisms, such as venture clients, venture builders, scouting missions, challenges prizes, corporate accelerators, to name a few.

Today's chief innovation officers are looking for data to feed their venturing decisions. So, how much time — and how much money — does it take to integrate value into the established company? Do costs vary for each mechanism? Which mechanisms are quickest? And the most cost-effective? How might costs be reduced, even while speeding things up? When is the right time to kill a venture that may not add value? Answers to these questions can be hard to find because of the novelty of the corporate venturing trend.

To help fill this need, the 2019 report, titled Open Innovation: Increasing Your Corporate Venturing Speed While Reducing the Cost, tallies up the numbers and insights from interviews with more than 120 chief innovation officers (and those in similar roles) who are involved in corporate venturing activities in the United States, Europe and Asia.

The report is the work of professor Mª Julia Prats and Josemaria Siota from IESE's Entrepreneurship and Innovation Center, together with Isabel Martinez-Monche and Yair Martínez from the consultancy firm BeRepublic.

How long should you wait before killing a venture?

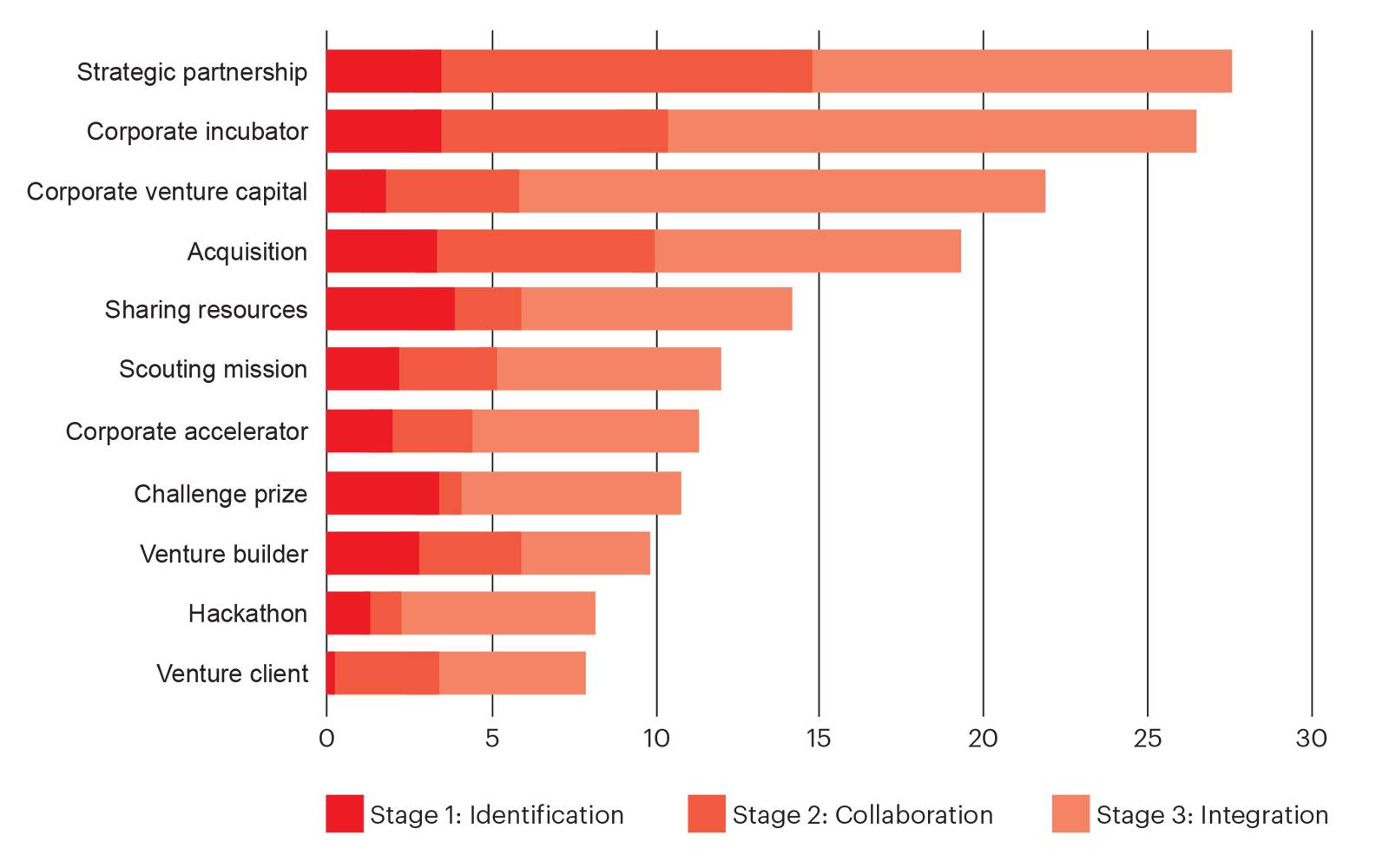

For corporate venturing initiatives — such as the AT&T Foundry — having more agility helps attract the best startups, which usually have to move quickly to keep ahead of cash-flow concerns. The report breaks down the time it typically takes to build a relationship and integrate value into the parent company. Of the three stages in a relationship — (1) identification, (2) collaboration and (3) integration — integration usually takes the longest, according to the executives interviewed. Digging into the data, the identification stage typically required from one to four months, depending on the mechanism used. Meanwhile, forging the collaboration usually lasted one to 11 months, and integration required four to 16 months.

Reviewing these time frames can help executives gauge when a venturing opportunity is going off course. Note that for corporate accelerators, venture builders and venture clients, the typical opportunity required less than a year all told.

How much will each opportunity cost?

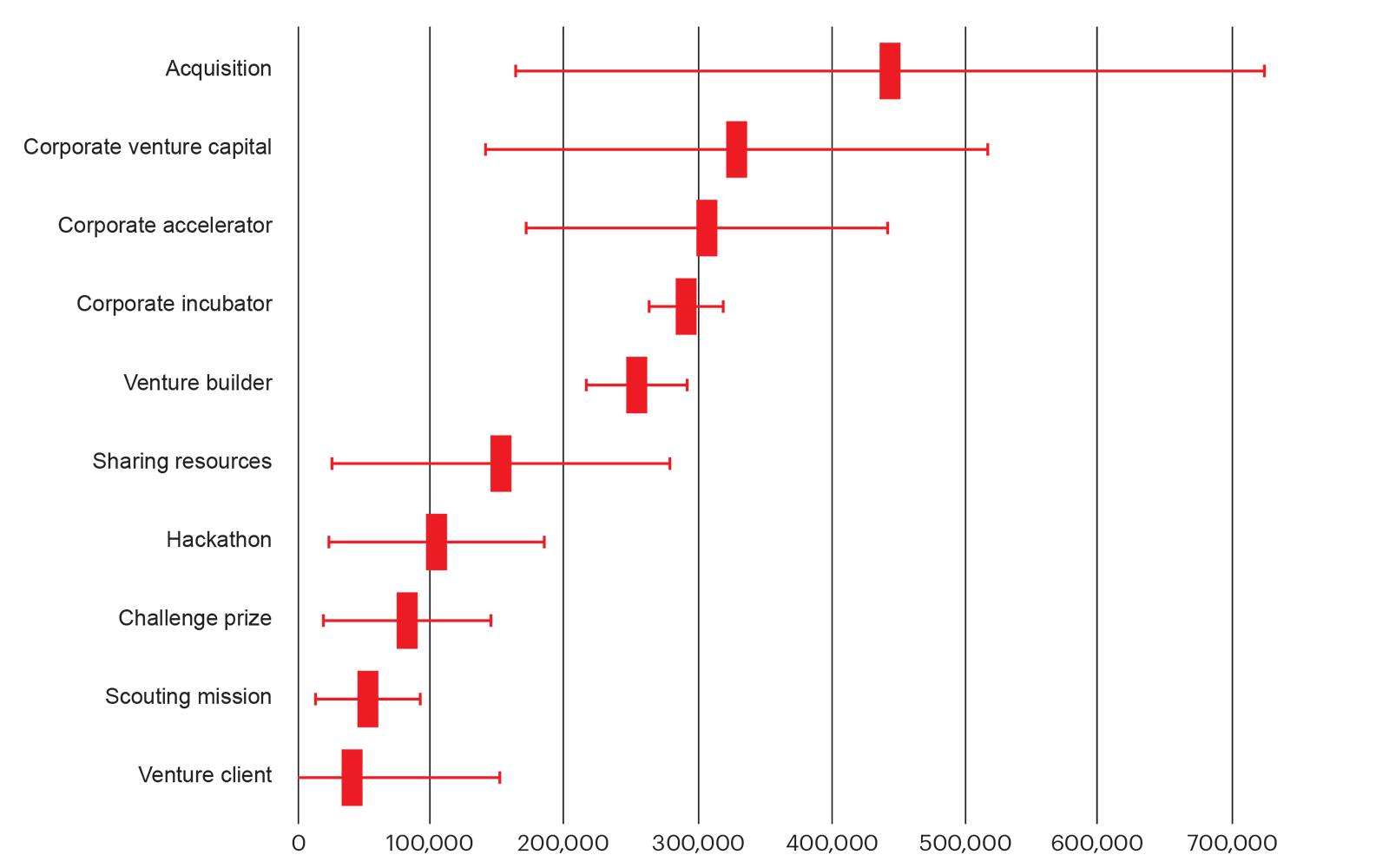

Average costs ranged from about 50,000 to 310,000 euros, depending on the mechanism. The least expensive, venture client, cost an average of 47,000 euros, while venture builders cost around 250,000 euros — and four other mechanisms cost more. These figures include the ongoing cost per opportunity per year, which includes the internal cost of full-time equivalent employees and the annual managerial cost of the mechanism, excluding investment.

What do hares do differently? Speed vs. cost

What separates the faster and more cost-efficient hares from the corporate turtles? The study identifies several differentiators, including:

- Sharing innovation costs between corporate, business and venturing units — what the report calls the "joint three pockets rule." For instance, finance a proof of concept with a third of the budget from the corporate venturing team, a third from corporate headquarters and a third from a business unit. Then, in the decision-making process, involve a member from each axis. This can increase the overall budget for innovation and boost other business units' involvement in the projects.

- Being skeptical about corporate incubators. Evaluate other mechanism that may give you more with less. For instance, the venture client entails around a sixth of the cost and a third of the time that corporate incubators require, on average.

- Connecting your corporate venturing initiatives by designing a holistic strategy and sharing that inside and outside your corporation. For instance, understand that the scout who identifies an opportunity may introduce it to the corporate accelerator, which may then lead to a corporate venture capital (CVC) investment, followed by an acquisition proposal. With a holistic strategy, redundancies can be decreased and more value can be generated.

- Adopting "agile principles." These include delegated authorities; flatter, faster, simpler structures; freedom to test new ideas; modular processes; bureaucracy aversion; ownership mentality; and a bias to action. Agility is especially key in the integration stage, the report notes.

- Using data — instead of relying on intuition or following media hype — when choosing the optimal combination of corporate venturing mechanisms and when identifying bottlenecks at the stage they occur -- either during identification, collaboration or integration.The seven lies of corporate venturing

Have you ever heard the following about corporate venturing?

- It's only CVC.

- It's only for very large corporations.

- It requires a large investment to start.

- It's financially unsustainable.

- It will provide short-term results.

- It's only useful for early- or late-stage startups.

- My established corporation is better than any startup...These were the seven most common misunderstandings identified by the authors in the course of interviewing scores of executives. The study provides counter-examples, data and theory to help debunk these myths.

In short, the authors' conclusions aim to help leaders define their corporate venturing strategies with more precision and select the most appropriate combination of corporate venturing mechanisms. Additionally, the compiled data should provide innovation managers with benchmarks to see if they might be spending too much or advancing too slowly.

Methodology, very briefly

The report is based on 121 interviews with firms' chief innovation officers (and those in related roles) in the United States, Europe and Asia.

Previous studies on corporate venturing: "Corporate venturing: a David-and-Goliath collaboration" and "The how-to guide for corporate venturing".