IESE Insight

Corporate venturing: how much autonomy will maximize impact?

When established firms and startups collaborate on innovation, getting the right mix of autonomy, control and integration isn't easy. This report identifies how corporate venturing is working and which key processes help maximize its impact.

Chief innovation officers know that corporate venturing — the collaboration between established firms and innovative startups — can yield strong results. Its implementation, however — especially finding the right balance between autonomy and control — can prove challenging.

A new study pulls from the experiences of companies such as BMW, Orange, Samsung and Disney to shed light on getting that balance right. The goal is not only to maximize the innovation produced but also the value for the parent company. The study Open Balancing the autonomy and the impact of your corporate venturing unit — based on over 120 interviews with chief innovation officers and those in related roles in the United States, Europe and Asia — is part of ongoing work on corporate venturing by IESE's Mª Julia Prats and Josemaria Siota of the Entrepreneurship and Innovation Center, in collaboration with Isabel Martinez-Monche and Yair Martínez from the consultancy firm BeRepublic.

This report serves as a reminder that collaborations with startups go beyond corporate venture capital, that autonomy is not merely a matter of location, and that financial figures are not the only way to measure progress.

Autonomy isn't always "out of headquarters"

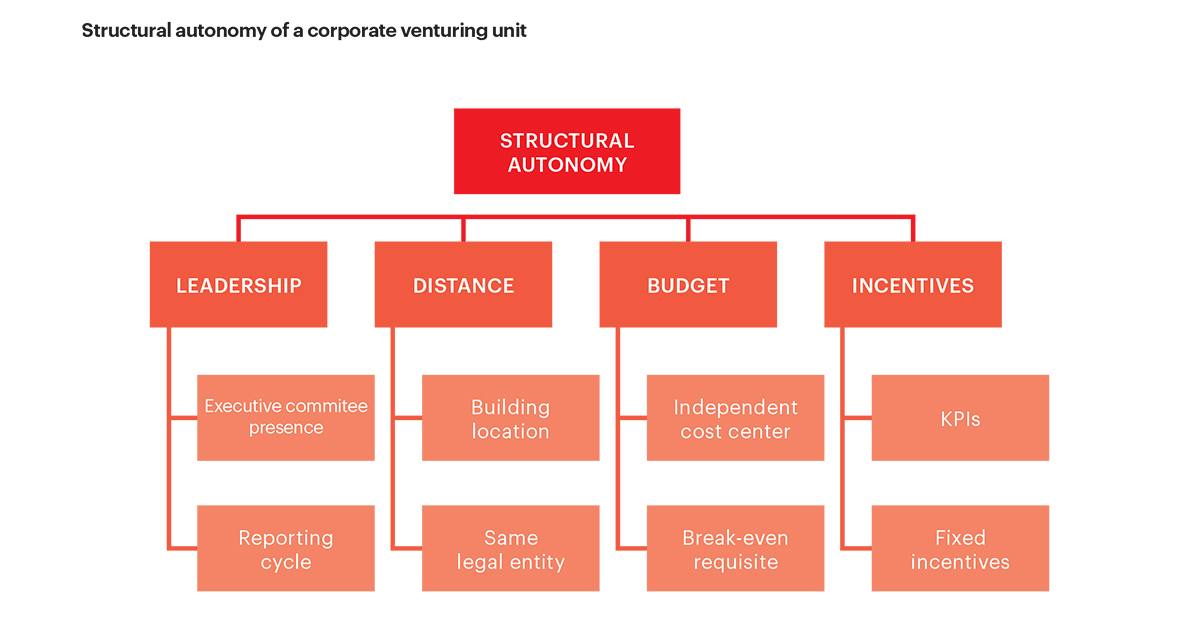

Often with corporate venturing units, the idea of the unit's autonomy from the larger firm is simplified to mean they are located outside of the main building. Yet the interviews revealed a more nuanced understanding along four main pillars:

- Leadership: To what degree does the executive committee participate in the unit's decision-making, and how much time elapses between reporting cycles?

- Distance: How far is the unit from headquarters? This considers both physical and legal distance.

- Budget: How dependent is the cost center on headquarters? How much is required for them to break even?

- Incentives: How is the unit director evaluated and compensated?

Indeed, when all of these factors are taken into account, it may be neither necessary nor desirable for the corporate venturing unit to be located away from the main office. Many of the mechanisms necessary to ensure the unit's autonomy can be employed within headquarters.

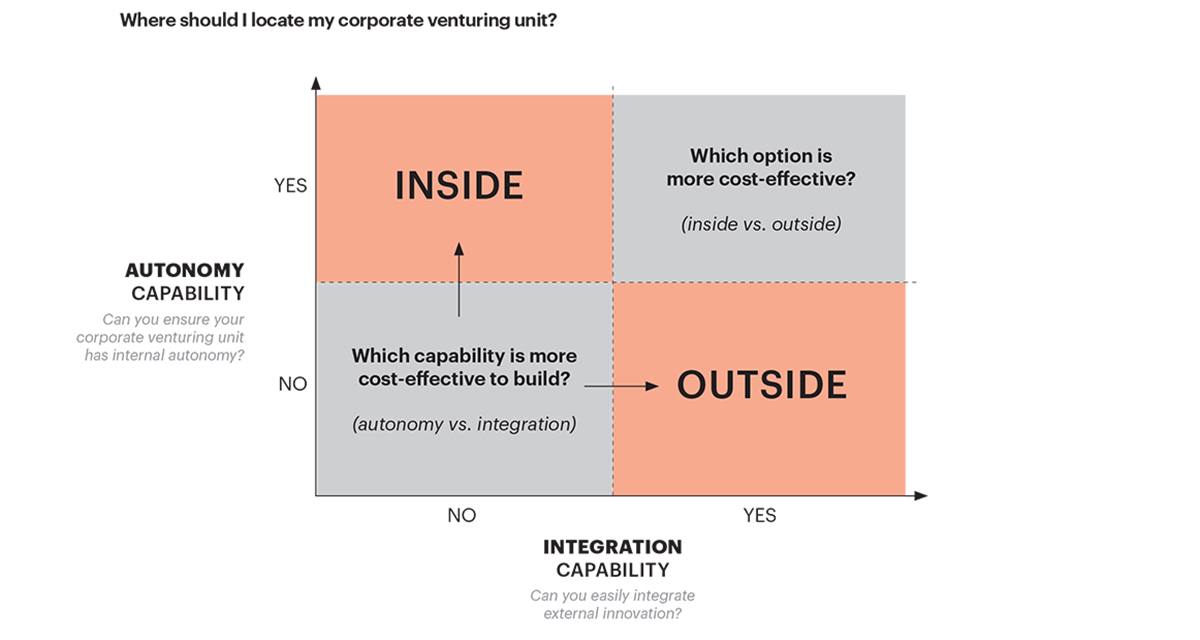

In the real world, both internal and external systems can be successful. For example, French telecom Orange has an internal unit, while Korea's Samsung has its located outside of headquarters. Both systems have potential pros and cons, illustrating again the fine balance that needs to be struck: on the one hand, granting real freedom to operate and, on the other hand, maintaining corporate involvement and a degree of control.

What is essential, the authors insist, is the established company's cultural readiness to host a corporate venturing unit. This means ensuring the unit's internal autonomy, as well as being realistic about the parent company's ability to integrate innovation. Is your company set up to integrate innovation effectively? The cost-effectiveness of ensuring either autonomy or integration, or of housing the unit inside or outside of HQ, will also impact each company's decision.

It's not about more freedom per se

A well-designed corporate venturing strategy

needs to be adapted to each individual case, but all should be concerned with maximizing both innovation and its integration into the company to generate real value. The extensive interviews behind the report revealed some good practices to help parent companies incorporate more value:

- Design metrics and incentives oriented to value integration. This will help you focus on the value generated, not just innovating for the sake of innovation.

- Don't only use financial metrics to measure value. New knowledge, products and services, an innovative mindset, processes, and business models . . . the list of potential non-financial returns goes on. Don't be simplistic; it's not just about the money!

- Ensure there is an independent cost center. To avoid the need for bureaucratic approvals at every step, make sure you have a budget to speedily approve internal innovation processes.

- Involve a sponsor from the parent company's executive committee in decision-making. This person will help integrate value into the parent company and speed up the venturing process. Find someone who understands how the corporate venturing process works.

- Consider increasing the time span of the reporting cycles. This can provide greater autonomy. Reporting to a member of parent company's executive committee should be a process not of auditing but of catalyzing.

In short, freedom isn't the same as a free-for-all. It's about providing an adequate structure to allow innovative partnerships to flourish.

Methodology, very briefly

The report is based on 120+ interviews with firms' chief innovation officers (and those in related roles) in the United States, Europe and Asia.

Previous studies on corporate venturing

"Corporate venturing: how to boost speed while reducing costs".

"Corporate venturing: a David-and-Goliath collaboration".

"The how-to guide for corporate venturing".