IESE Insight

Deter corporate crime with a culture of integrity

Better oversight and strong leadership are key to making it clear to all employees that crime doesn’t pay.

In March 2024, Sam Bankman-Fried, previously convicted of defrauding customers of his cryptocurrency exchange FTX, was sentenced for his crimes. In seeking leniency, his defense team had tried to argue that his was a victimless crime, in that he wasn’t “a ruthless financial serial killer” but rather an “awkward math nerd,” and that investors would eventually get their money back. “I never intended to hurt anyone or take anyone’s money,” Bankman-Fried insisted. “I never thought that what I was doing was illegal.” These are typical justifications in cases of corporate crime. But the judge wasn’t buying any of it and sentenced Bankman-Fried to 25 years in prison.

History is littered with similar cases of apparently successful businesspeople and companies engaging in material corporate crime, such as fraud, corruption and money laundering. Since the start of this century, Enron, WorldCom, Parmalat, Siemens, Lehman Brothers, Petrobras, Wells Fargo, Volkswagen, Wirecard, Theranos and FTX have become household names for their widely publicized scandals. For many of these companies, the resulting financial damages and loss of investor and customer trust precipitated their collapse. In other cases, the scandal led to costly lawsuits and reparations, damaged the company’s reputation, and distracted management while they dealt with the fallout.

Public concerns over corporate scandals and trust in financial markets have generated new regulatory efforts to deter crime, such as the Foreign Corrupt Practices Act and the Sarbanes-Oxley Act in the U.S. and the Bribery Act in the U.K. As a result, virtually every public company invests in and claims to encourage compliance.

Despite these efforts, a 2022 PwC Global Economic Crime and Fraud Survey documents that the incidence of corporate crime has increased over time: More than half of the firms responding to the survey reported that they had experienced fraud in the past two years, the highest level in 20 years of PwC’s research.

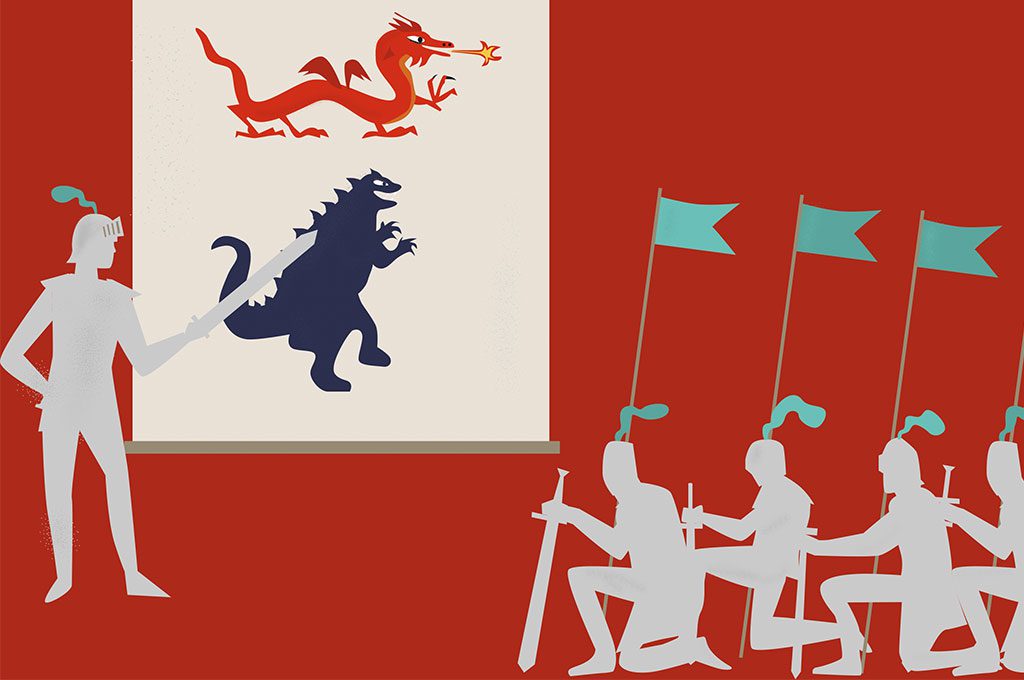

Some argue that these failures are caused by a few bad apples, and that every firm will inevitably have some, making the occasional lapse impossible to avoid. However, a growing body of research identifies some common failings that enable the bad apples and may even pressure well-intentioned employees to look the other way or participate in misconduct. Thankfully, this same research suggests effective ways to reduce the risk and magnitude of misconduct before it becomes widespread.

Causes of corporate scandals

Over the past decade, colleagues and I have conducted research on corporate crime, ranging from analyses of public and proprietary data to in-depth interviews of the perpetrators of crime and their colleagues. A common pattern at companies experiencing significant misconduct is that their leaders enabled employees to rationalize bad behavior. In such circumstances, employees faced with performance pressure were tempted to take shortcuts or even commit crimes. We observed this enabling behavior in several ways.

1. A focus on meeting performance goals at any cost. This creates a destructive tone at the top. In a case study I did on Siemens, employees reported that their managers had encouraged them to just get the business and made it clear they wouldn’t ask how it was achieved. Consequently, when performance and competitive pressures escalated, some employees paid bribes to generate business.

Another case study by Harvard colleagues on “Sales misconduct at Wells Fargo community bank” reveals how employees were pressured to cross-sell products to customers to meet company goals. In response, some resorted to adding new services to customer accounts without their permission.

A Harvard case on Theranos reveals another pressure tactic: Founder Elizabeth Holmes and CEO Sunny Balwani fired any employees who dared question the viability of the company’s technology, sending a strong message to the remaining employees that raising questions was unacceptable.

READ ALSO: “Crossing the line: 3 stages when entrepreneurship can go wrong”

2. Warnings ignored. When boards and executives ignore problems, they send a message to employees that they aren’t committed to addressing them.

Siemens’ board and executives should have been alerted by 1999 regulatory changes in Germany that outlawed international corruption, by corruption charges in Switzerland and Italy in the early 2000s, and by the decision to list in the U.S. where anticorruption laws were more actively enforced.

Likewise, Wells Fargo’s board and executives should have been alerted by employee turnover data and several high-profile press articles questioning the company’s aggressive sales tactics.

When employees see management failing to react to these types of public challenges, they are likely to infer they are not high priority.

3. Double standards. Employees also infer that managers aren’t really committed to business integrity when they observe double standards in meting out punishments to perpetrators of corporate crime.

In our paper “Who pays for white-collar crime?” George Serafeim and I found that perpetrators of crimes who are senior executive men tend to receive lighter punishments than junior perpetrators or senior executive women. If firms fail to prosecute or even fire perpetrators who are senior male colleagues, what message is that sending to others in the organization about the importance of following the rules?

4. Downplaying the harm. Eugene Soltes has studied many of the most infamous corporate criminals of the past 20 years. In his book Why they do it: inside the mind of the white-collar criminal, he found many people rationalized that their crimes didn’t really harm anyone and that there was little difference between their illegal actions and those that were legal. Of course, neither is true. But in contrast to violent crime, where the harm to the victim is clear, the victims of corporate crimes are unidentified shareholders, customers and/or competitors. We saw this in the Bankman-Fried defense. In reality, these types of justifications from the top only serve to weaken the tone and exacerbate the harms done.

Deterring corporate crime

An essential goal for all leaders should be to deter misconduct. Even though some corporate misconduct may be impossible to eliminate entirely, it is important that it not be allowed to escalate and permeate the company culture. Here’s how.