IESE Insight

Common ownership: implications for competition and markets

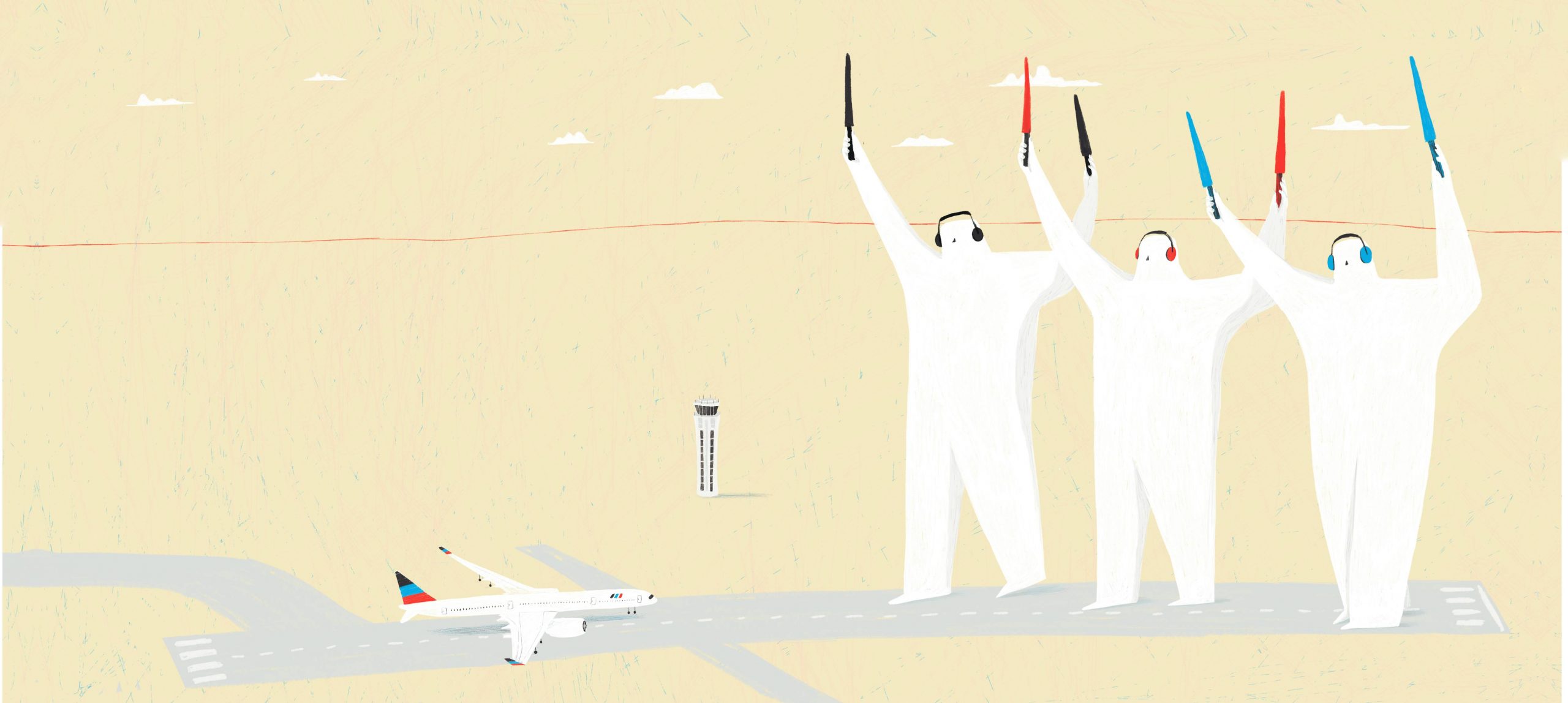

An interview with José Azar in which he explains some of his recent research on common ownership as well as labor market forces. He lets us in on common ownership's surprising implications for merger approvals, airline ticket prices and more.

The rise of common ownership — where the same large asset managers are major shareholders in many overlapping companies — is clear to see, if you know where to look. It is especially visible in the growing power of the Big Three: BlackRock, Vanguard and State Street, which together control trillions of dollars in their funds. This matters because common ownership has real implications for competition and markets. José Azar draws from his award-winning research to help us understand some key forces in play.

Tell us about the beyond in the title of your recent paper "Beyond the target: M&A decisions and rival ownership," published in the Journal of Financial Economics.

It looks at common ownership in merging companies and beyond. Here's how it started. About four years ago, Miguel Anton, Mireia Giné, Luca Lin (who was then getting his PhD at IESE and is now a professor at HEC Montreal) and I took a new look at a long-standing question: why do so many mergers seem to end up as bad deals for the acquirer?

The M&A literature offers possible explanations. Maybe the top managers are overconfident; or they are empire-building, essentially not acting in the interest of the shareholders, so that they can run bigger firms. And then there was an interesting 2008 paper by Gregor Matvos and Michael Ostrovsky ("Cross-ownership, returns and voting in mergers") that considered cross-ownership of both the acquirer and the target of the merger — acknowledging that shareholders in the acquirer may recoup at least part of what they are losing if they are also shareholders in the target. But soon after, another paper came out showing that cross-ownership in the acquirer and the target is simply not enough to explain what's happening.

My IESE colleagues and I decided to look beyond both the acquirer and the target, hence our paper's title. Consider: when two firms merge, a classic economic model has it that the merging firms lose value unless efficiencies are created. At the same time, the non-merging firms in the same industry can benefit. This is known as "Cournot's merger paradox." In simple terms, suppose you have five firms in an industry. If two of those five firms merge, you are left with just four. Those four can be more profitable, sharing the market four ways. But is the merger good for the two firms that merged? Before, they were two firms out of five, and now they are just one out of four, essentially shrinking in size.

Here is where common ownership comes in. If the merging companies' shareholders have, in their portfolios, other firms in the industry, then they could actually benefit from their rivals' gains.