IESE Insight

Buyers helping suppliers to boost business for all

It's a win-win situation. When big buyers help smaller suppliers secure financing, costs go down, order fill rates climb, and the whole supply chain benefits — with a double-digit (11.8%) boost to channel profits. Weiming Zhu's practical research on supplier financing is especially relevant in developing economies, such as China.

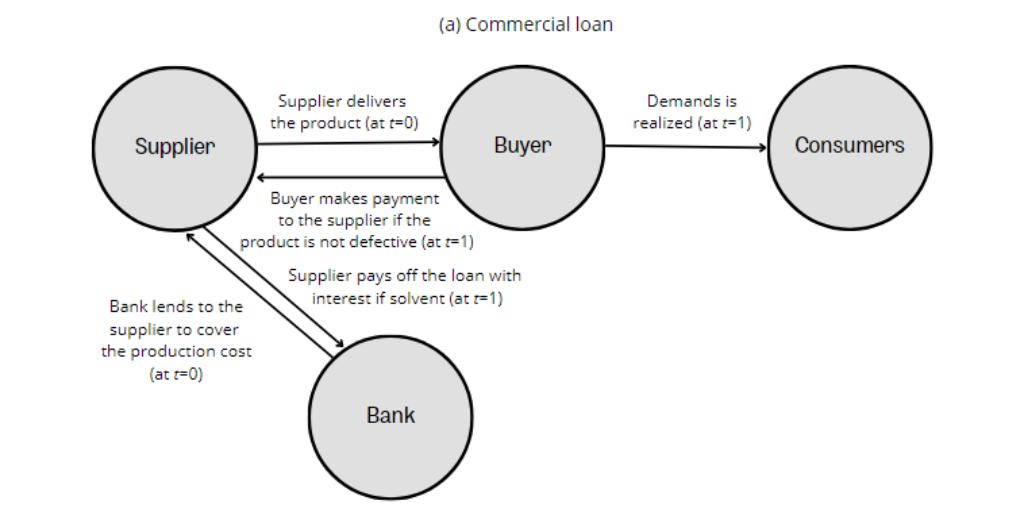

A big buyer — imagine it's China's largest online retailer — may rely on thousands of suppliers, some of them small. But small suppliers may struggle to find financing to ramp up their production to fulfill orders on time. These financing needs might be met by banks' commercial loans, but — especially in developing nations — there may be few lenders that are willing to take on the default risk. And those lenders who do take risks take them at a price — i.e., at relatively high interest rates that then raise suppliers' costs.

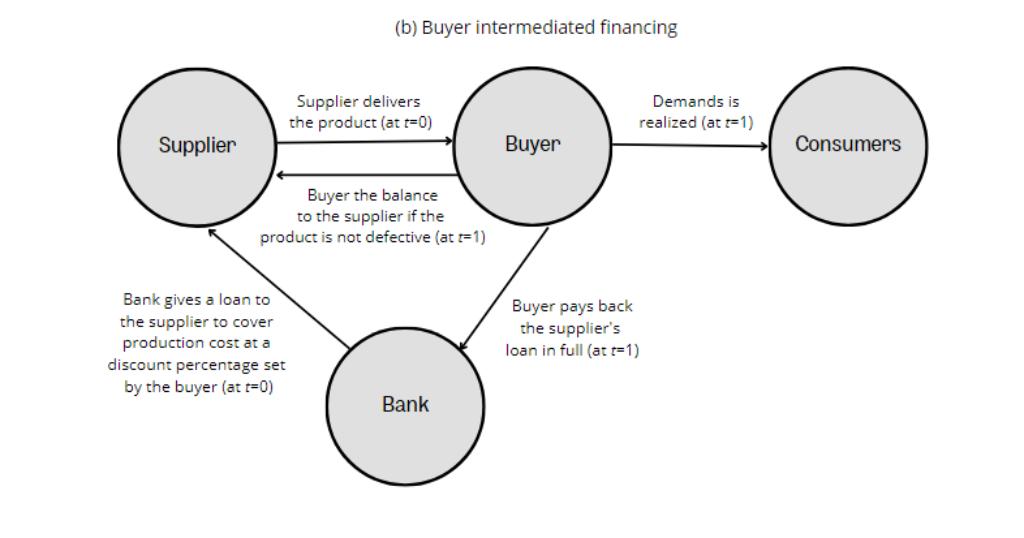

But now there's an increasingly popular way to help suppliers find financing for their operations. It's called buyer intermediated financing.

In a nutshell, buyer intermediated financing is when a buyer steps in to help secure a supplier's loan. Because the buyer knows about its supplier's business — pending orders, etc. — that company is in a good position to essentially underwrite a bank loan. As a result, bank risk is lowered — and so is the interest rate.

According to research by Tunay I. Tunca and IESE's Weiming Zhu, the benefits don't stop there. The channel as a whole benefits with buyer intermediation in financing. To show this, the co-authors build a theoretical model and also crunch real data from JD.com, China's largest online retailer, which is an active intermediator in supplier financing.

(For the record, JD offered more than a million products and recorded $38 billion in annual sales in 2016.)

Here are the paper's most salient findings:

- With buyer intermediated financing (BIF), suppliers' interest rates were less than half what they would have been for commercial loans without intermediation. In the study, the average interest rate for commercial loans was 20.16 percent, while the BIF interest rate was a flat 9 percent.

- As a result, wholesale prices fell. At the same time, order fill rates climbed.

- Under BIF, suppliers borrow a higher percentage of their production costs, bringing more business to banks.

Crunching the numbers, the co-authors calculate that buyer intermediated financing yields an 11.8 percent increase in profits to the channel. The double-digit boost comes from transferring risk among supply chain members in a novel way, lowering prices and boosting order fill rates along the way. These results are especially relevant when suppliers face cash constraints.

The two time periods in the model are labeled t = 0 and 1. Source: Management Science.

Methodology, Very Briefly

The co-authors analyzed the details of the two financing models above to provide a theoretical layout. They then analyzed 2012-2013 data from JD.com, the largest Chinese online retailer, which launched a BIF scheme at the end of 2012 that was adopted by a wide range of suppliers during 2013. The data consist of 9,228 SKU observations sourced from 170 different and randomly selected JD suppliers. Among these suppliers, 114 had used the BIF service provided by JD, while the other 56 who had not used it were analyzed as control group participants.