IESE Insight

Starting up amid a global slowdown: Spain's business angels are optimistic

Economic growth may be slowing, but startups in Spain are nonetheless enjoying a healthy influx of international funding and increased corporate venturing.

If there are signs of a startup bubble, it's not likely to burst in 2019, according to the investors surveyed in the 2019 report on business angels in Spain.

Only 3 out of 10 business angels believe startups will have a harder time securing financing going forward. Despite the global economic slowdown, Spain's entrepreneurs are expected to benefit from increased international investment and corporate venturing, as well as business angels' continued stability in investment capacity.

These are some of the conclusions gathered in the annual report prepared by IESE professor Juan Roure and Amparo de San José, director of IESE's Network of Private Investors and Family Offices, for the Spanish Association of Business Angels (AEBAN). The report offers a comprehensive look at the activity of Spain's business angels and their relationships with startups in 2018, along with some projected trends for 2019.

A rather stable profile

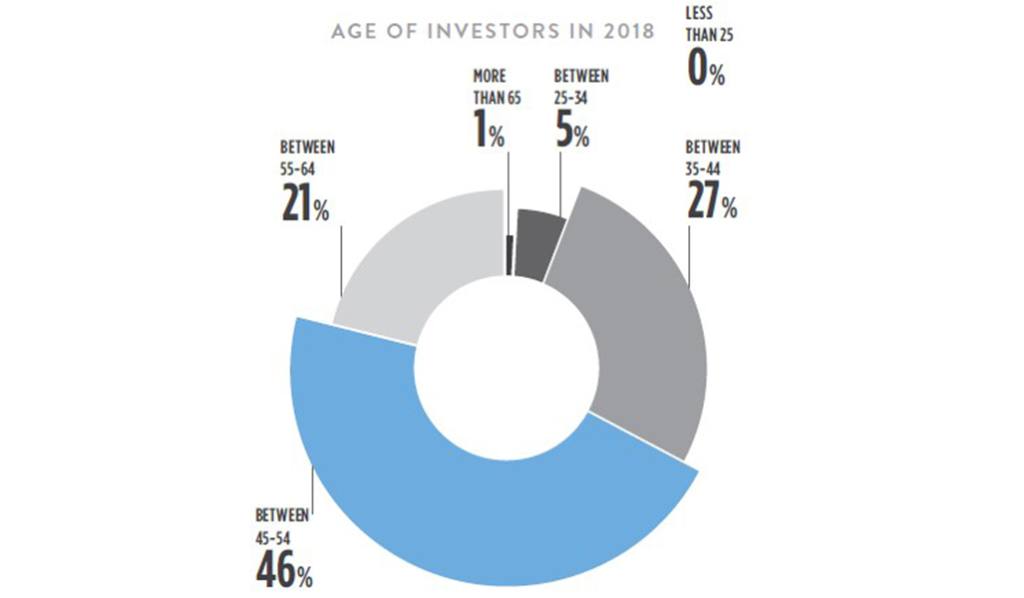

Although the profile of the typical Spanish business angel has not varied much from year to year, there is a slight increase in the average age: 68% of survey respondents are over 45 years old.

In recent years, the number of investors in the 45-54 age bracket has nearly doubled, while the number of investors aged 25-44 has declined.

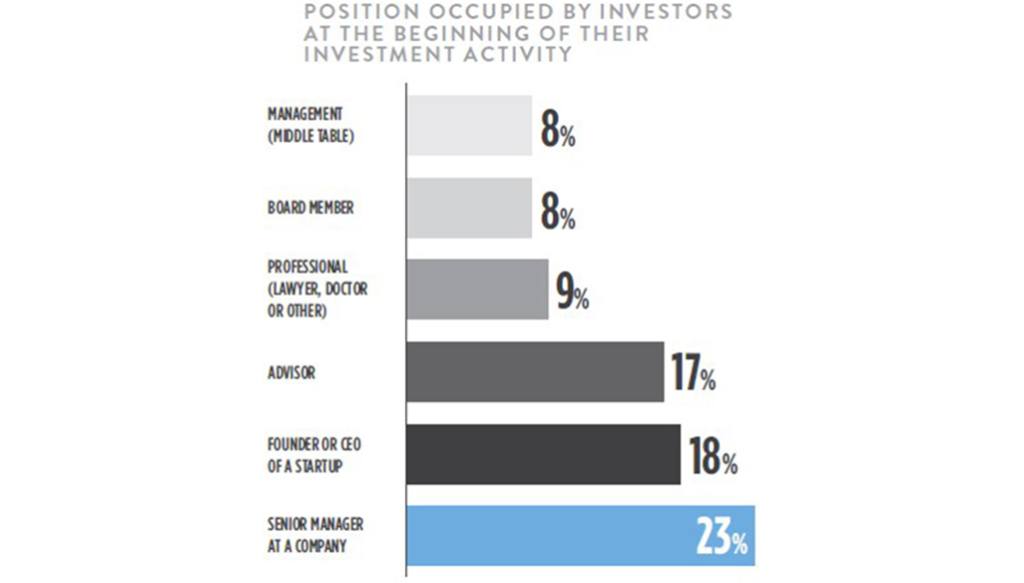

The report also highlights that only 18% of investors have experience as founders or CEOs of startups themselves. The most common professional background for business angels is senior management in a company (23%). In terms of the sectors they hail from, technology (32%) and finance (26%) are the two most popular.

Most of the investors surveyed (52%) got started between 2012 and 2017, and thus have 1-6 years of experience.

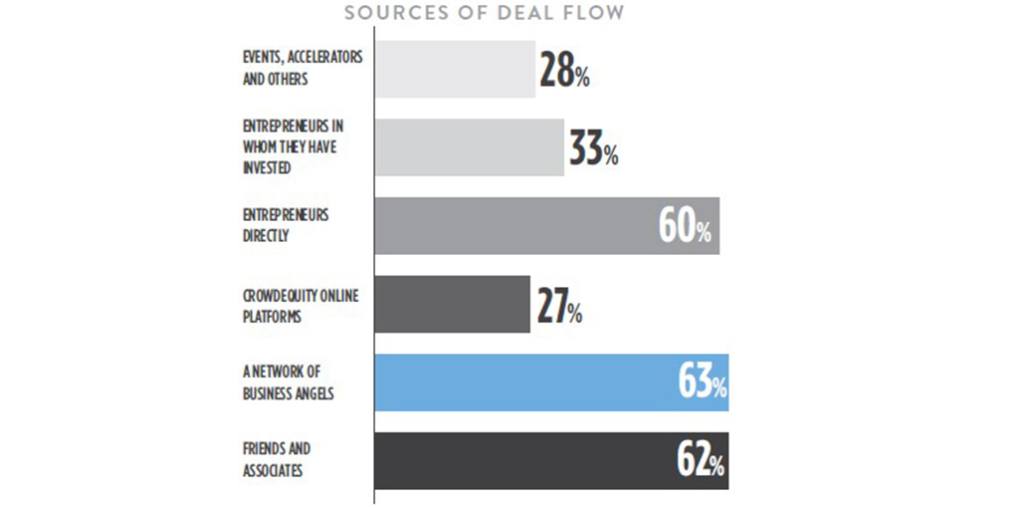

They found their investment opportunities mainly through business angel networks (63%), friends and associates (62%) and directly from the entrepreneurs (60%). Crowdequity platforms were also a newly notable presence, used by 27% of investors.

The typical portfolio

In 2018, the average investment amount and the most common ticket size both declined by about 20% compared with 2017. Specifically, 2018's average investment per angel was 37,600 euros, down almost 10,000 euros from the year before. Meanwhile the most common ticket size per investment was 20,000 euros, compared with 25,000 euros the year before.

And while portfolios continue to improve in terms of diversification — the percentage of respondents with fewer than six investments in their portfolios fell from 53% in 2017 to 44% in 2018 — the authors strongly recommend a further expansion in the number of projects to reduce exposure to risk.

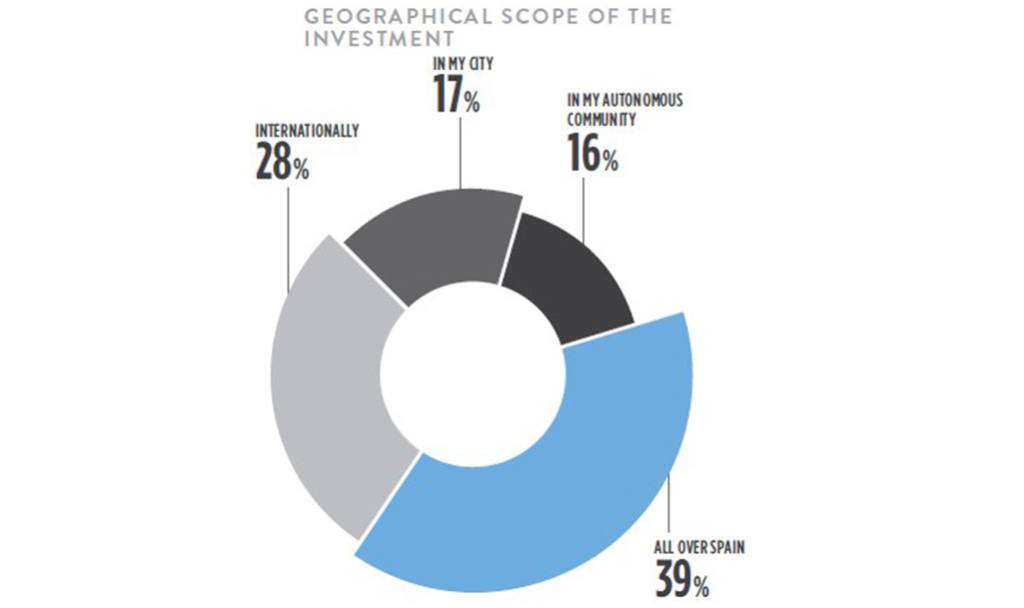

Meanwhile, investment in domestic startups continues to lead the way, although a significant percentage (28%) also indicate they invest internationally.

In 2018, the most popular sectors continued to be software (57% of active investors) and banking and finance (31%), although there was a notable uptick in the health arena, which has risen to 29% if biotechnology and pharma investments are included.

Annual investment capacity remains quite limited: nearly half (47%) of survey participants allocate less than 50,000 euros to deals per year and only 1 in 3 allot more than 100,000 euros. This capacity limit is also due to prudence: 68% indicated they would dedicate less than 10% of their assets to startup deals.

Market conditions

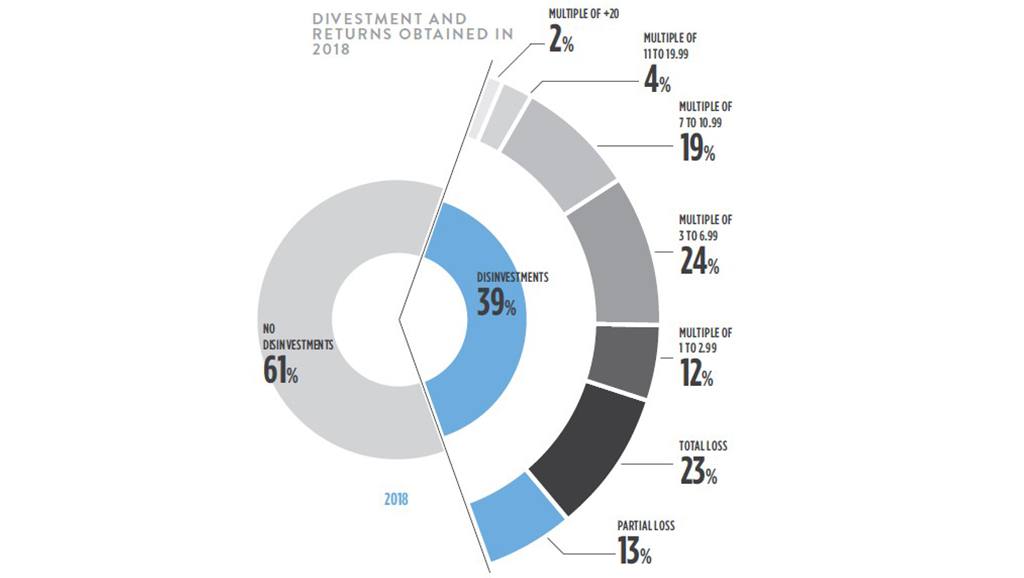

The report notes that "the so longed for liquidity" is still limited. This helps explain why 61% of respondents did not divest from anything in 2018. Among those who did cash out, almost half (43%) saw returns that were between 3 and 11 times higher than their initial investments, while about 40% lost money. Note that the authors caution that data is still scarce on divestments.

As for valuations, there was a slight increase (9.3%) for the startups at more advanced stages, just prior to Series A and with market traction. This situation contrasts with that of entrepreneurs seeking financing for the initial stages — seed capital — whose average value has dropped from 912,000 euros in 2017 to 700,000 euros in 2018.

For 2019, investors surveyed say they anticipate a greater inflow of international funds and a growing role for corporate venturing, as well as more technological specialization among investors.

Perhaps most important, despite the uncertain economic outlook, most investors were optimistic about startups getting funded in 2019 and beyond.

Methodology, very briefly

The report is based on responses to an 18-question survey that was sent collectively to all AEBAN networks and partners and individually by the authors to more than 400 active investors.